Cap Table Template for Pre-Seed Startups

A simple cap table to get you from formation to your first priced round.

What is a cap table?

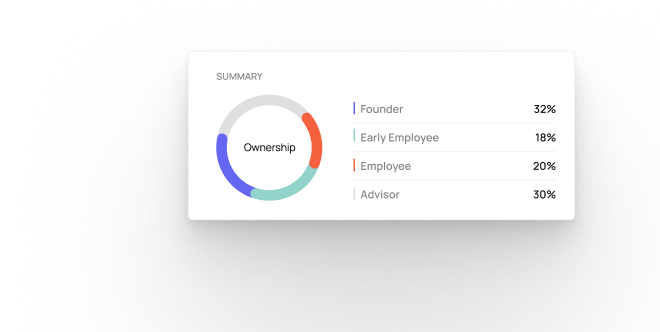

A cap table (short for “capitalization table”) is a document that shows who owns how much of your company, whether now or in the future. For example, a cap table shows who the company’s stockholders are and how much shares each owns. It also shows if anyone has options, warrants, safes, or convertible notes in the company – types of securities that can turn into stock in the future. Absence of a properly maintained cap table can lead to costly disputes among actual or purported stockholders.

Why is a cap table important?

Think of the cap table as your single source of truth as to who owns what share of your company. If there are questions about the ownership structure of your company, the first place you would look to find questions is the cap table.

Also, for U.S. companies, there is no governmental agency – whether federal or state – that maintains a list of that company’s stockholders, which is normally the case for European companies. In other words, there is no external resource to rely on to double-check the ownership structure of a company; it’s all reflected in an internally maintained cap table.

What’s covered in a cap table?

Essentially, any securities interest in the company (such as common stock, options, safes, etc.) is reflected on the cap table, along with relevant information (vesting schedules, valuation caps, etc.). Here’s a brief overview:

Common Stock

When you’re just starting out your company, chances are your Certificate of Incorporation authorizes only one type of common stock, and that’s exactly what your founders and early employees get. For an overview of common stock vs. preferred stock, check out this blog post.

Preferred Stock

When you do your first priced round, you’ll likely be issuing preferred stock to your investors, and your Certificate of Incorporation will be amended to allow (aka, “authorize”) this. Preferred stock can come in different series – such as Series Seed, Series A, etc. – and each will be documented separately in your cap table. Since this cap table template is for pre-seed startups, we’ve left out mentions of preferred stock.

Equity Incentive Plan

Your cap table also tracks grants under your equity incentive plan (aka, “stock plan”) once you adopt it and start granting equity through it. You’ve probably heard of options – these are granted under the equity incentive plan. Additionally, common stock can also be granted under the equity incentive plan, in the form of “restricted stock awards”. It’s good practice to document any such grants under the stock plan separately in your cap table.

Safes and Convertible Notes

Pre-seed investments are normally in the form of safes and convertible notes. These aren’t shares just yet – instead, they’re a “promise” to the investor that when the company does a priced round and issues preferred shares, the investor’s safe or convertible note will be traded in for (or “converted into”) preferred shares. For a thorough overview of safes and a comparison with convertible notes, check out blog post.

Warrants

These are kind of like options, but they’re usually intended for investors, sometimes also accelerators. They’re normally used as a tool to “sweeten” the deal. Like options, the holder of the warrant has the right to “exercise” the warrant and have it convert into stock. We’ve left out warrants from this version of the cap table to keep it simple.

Who should have a cap table, and who’s responsible for maintaining it?

Every company should have a cap table for the reasons mentioned above. If you have a corporate/startup lawyer, normally, the lawyer will be the one making sure the cap table is accurate. If you don’t have a lawyer, the task of maintaining the cap table normally falls upon the shoulders of the secretary.

Could you share a cap table example?

Certainly! The cap table template is actually modeled as an example, with most of the fields pre-filled in. It gives you an idea what a pre-seed startup’s cap table normally looks like. Check it out here.

Why did you prepare this cap table template?

We wanted to create a simple cap table template specifically for pre-seed startups, because the alternatives out there are just too complicated for them. Cap table management software is great, but they come with a lot of bells and whistles that are so confusing for founders (and lots of attorneys, too!). We also found excellent cap table templates online, but they‘re packed with so many data entry points which make them an overkill for pre-seed startups. So, we trimmed down the model cap table to only what’s absolutely critical to document.

How should I use this cap table template?

Access the cap table template, make a copy of it, and you’re good to go! Make sure to modify values in the yellow-shaded fields only. If you need to add additional rows in the separate tabs (“Common Stock”, “Equity Incentive Plan”, or “Safe and Notes”), then you would have to create new rows in the “Overview” tab to accommodate the new information (we’re still trying to figure out how to automate this – if you have the answer, please let us know!).

Why should I trust this cap table template?

Great question. This template was created by our co-founder, Stepan Khzrtian, who practiced corporate law for over a decade and worked with hundreds of founders, including creating and maintaining cap table for many of them. Also, Corpora’s cap table is maintained on this exact same template.

Is this sample cap table for everyone?

Unfortunately, no. We’ve aimed for the “lowest common denominator” here. For example, if your company has two types of common stock (for example, “Class A Common Stock and Class B Common Stock”), the cap table doesn’t account for this. Similarly, we’ve left out stock option exercises and warrants. That said, with a few tweaks, you can adjust this cap table to accommodate for such variations.

FAQs

Corpora is intended for high-growth Delaware corporations that are in their earlier stages, from formation through Series B.

Corpora’s goal is not to displace attorneys but instead facilitate the collaboration between startups and their attorneys. We give founders the tools to get simple legal tasks done, while also giving their attorneys the tools to get the complex legal tasks done efficiently.

Corpora’s customer is the startup, which can give access to its account to its founders, attorney, and investors.

There’s little overlap between Corpora and equity management software. Corpora is doing to company legal documents what equity management software does to cap tables: taking a messy, manually tracked environment and turning it into an organized, automated solution.

Corpora’s infrastructure is built on the AWS platform, utilizing its suite of security and encryption features. We use current industry standards to store and secure our users’ documents. For more information, please visit our security page.