The Corpora

Podcast

Talking about startup law, technology, and the future of legal.

All episodes

BigLaw is overkill for startups | Kristina Subbotina of Lawlace

In this episode, we discuss, startup founders and the immigrant’s journey, tips on how to go from BigLaw to private practice, Lawlace as an AI-powered law firm, why BigLaw is overkill for startups, avoiding irreversible legal mistakes, what goes in a data room, creating legal content for founders.

Kristina Subbotina . 47 minutes

Law in Augmented Reality, with Taron Khachatryan of KnoxLabs

In this episode, we discuss, Virtual Reality (VR), Augmented Reality (AR), and Spatial Computing, Knoxlabs as the Everything VR marketplace, experimenting with AR hands-on, legal implications of AR/VR, including IP and privacy issues, how first-time founders and second-time founders think about legal, collaborating more efficiently with your lawyer, AR/VR for the benefit of humanity.

Taron Khachatryan . 34 minutes

From Law to LegalTech, with Ryan Samii of Standard Draft

In this episode, we discuss, how Standard Draft is changing the way lawyers negotiate contracts, Ryan’s journey from successful lawyer to legaltech founder, billable hour as a roadblock for selling to law firms, structural forces that will change the practice of law, defining your ideal customer profile for effective GTM, lawyers unwinding professional habits in order to become founders, AI x Legal: “fundamentally different” vs. “substantially better”.

Ryan Samii . 36 minutes

Navigating Legal to Series B, with Naré Vardanyan of Ntropy

In this episode, we discuss, how Ntropy is unlocking financial data for decision-making, how Ntropy balanced using legal templates and working with lawyers to get legal done, why founders are frustrated by lawyers who overcomplicate things, what legaltech startups can learn from fintech startups, why constantly having to bring your lawyer up to speed is inefficient – and what the alternative is, human threat vs. AI threat, and how uneven distribution of AI potential is dangerous.

Naré Vardanyan . 35 minutes

The Lawyer as Strategic Partner, with Eduard Grigoryan

In this episode, we discuss, when founders should hire a lawyer, what a founder should look for in a lawyer, things founders do that drive lawyers nuts, fundraising and keeping your house in order, DIY vs. hiring a lawyer, how to make law more accessible for founders, whether AI will replace lawyers.

Eduard Grigoryan . 32 minutes

How Founders Figure Out Legal, with Erin Beck

In this episode, we discuss, how founders figure out legal before hiring a lawyer, how long a founder can go without hiring a lawyer, things lawyers do that drive founders nuts, what a founder should look for in a lawyer, how open founders should be toward legaltech, whether AI will – or should – replace lawyers.

Erin Beck . 30 minutes

Changing the Way Startups Access Legal Services

Ari Kaplan hosted Stepan Khzrtian to discuss the legal issues that startup founders can address with technology, whether advanced tools will change the way lawyers deliver legal services for startups, and how artificial intelligence is driving change in corporate matters.

Technology in the Legal Practice with Nareg Essaghoolian

In this episode, we discuss, lawyers doing mundane work that should be automated, Legal tech that Decrypted Law is experimenting with, the importance of legal audits, Legal debt, will AI replace lawyers? Should AI replace lawyers? Alternative fee structures, working with the right startup attorney

Nareg Essaghoolian . 27 minutes

The Science of Transactional Law with Hayk Mamajanyan

The science of transactional law, what makes a transactional lawyer, and how AI is changing the practice of law. Discussion with Hayk Mamajanyan, Partner at Rimôn Law.

Hayk Mamajanyan . 24 minutes

FAQs

Corpora is intended for high-growth Delaware corporations that are in their earlier stages, from formation through Series B.

Corpora’s goal is not to displace attorneys but instead facilitate the collaboration between startups and their attorneys. We give founders the tools to get simple legal tasks done, while also giving their attorneys the tools to get the complex legal tasks done efficiently.

Corpora’s customer is the startup, which can give access to its account to its founders, attorney, and investors.

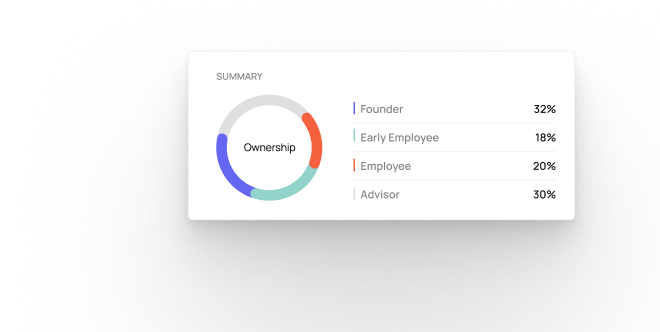

There’s little overlap between Corpora and equity management software. Corpora is doing to company legal documents what equity management software does to cap tables: taking a messy, manually tracked environment and turning it into an organized, automated solution.

Corpora’s infrastructure is built on the AWS platform, utilizing its suite of security and encryption features. We use current industry standards to store and secure our users’ documents. For more information, please visit our security page.