Corpora Blog

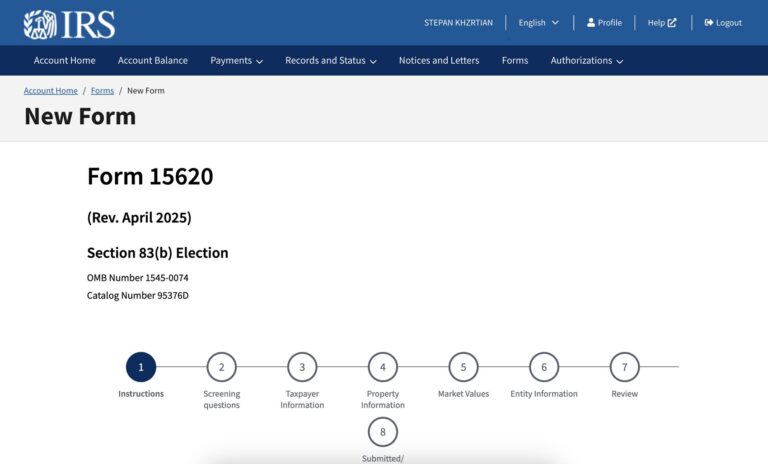

📣 Finally, the day has come! The IRS now accepts 83(b) elections electronically. ⚡ Taxpayers may continue mailing in their form if they’d like. (𝘉𝘶𝘵 𝘸𝘩𝘺 𝘸𝘰𝘶𝘭𝘥 𝘺𝘰𝘶?! 𝘙𝘦𝘢𝘥 𝘰𝘯 𝘵𝘰 𝘧𝘪𝘯𝘥 𝘰𝘶𝘵). A few months ago, the IRS released an official form for making a Section 83(b) Election – 𝗙𝗼𝗿𝗺 𝟭𝟱𝟲𝟮𝟬. Today,...

Key Takeaway The 83(b) election has to be made on paper – there’s no electronic or fax filing. Make sure you use USPS Certified Mail or an IRS-designated private delivery service to send your package to the IRS, and maintain good records as evidence that you’ve properly made the election. Intro...

The 83(b) election is arguably one of the most important tax forms to file if you received equity that is subject to vesting such as restricted stock or profits interests. 83(b) elections have saved taxpayers millions of dollars over the years, but there are some rigid rules involved with filing that...

Key takeaway While the 83(b) election form seems straightforward, some items require additional clarification. This blog post provides actionable tips so that you get your form right. Intro You start filling in your 83(b) election form. It seems like a breeze! You fill in your name, your address,...

Key Takeaway You have 30 days from the day you get your equity to file an 83(b) election with the IRS. You meet the deadline when you properly mail it on time – regardless of when it’s delivered. Intro You’ve heard the magic number so many times: 30 days. If you’re getting stock that is subject...

Key takeaway The 83(b) election is available to you even as a non-U.S. taxpayer. If there’s any possibility that you may become a U.S. taxpayer during your vesting schedule (usually, four years), then filing the 83(b) election while you do have the chance can help you save handsomely on taxes later...

Legal: as a startup founder, it’s probably not your number one skill. That’s normal. If you’re running a startup, you’re likely trained in another discipline. Think: computer science, marketing, finance or sales. Legal is, understandably, an afterthought – you’re focused on building. But the law dictates...

One of the most common mistakes that those who are new to venture capital make is to confuse value dilution and percentage dilution, two related but different concepts. Before diving into the two most common types of dilution (value and percentage), let us first understand how most startup companies...

Navigating the legal landscape can be one of the most mental bandwidth-draining aspects of running a startup. This guide offers a generalized legal checklist built for a hypothetical startup at various stages of its lifecycle, focusing on the unique “Jobs to be Done” (JTBD) at each such stage.

Key takeaway: Safes aren’t equity (yet) or debt. Instead, they will turn into equity if the company does a priced round. If the company exits, the safe investor gets back their money along with a return. If the company fails, the safe investor is paid back the investment in full or in part, assuming...

This is the first post of What’s The Difference?, a series of blog posts that highlight the main differences between similar or complementary concepts of startup law. Keep in mind that the post sacrifices detail for simplicity and is for informational purposes only. It should not be taken as advice...

This is the fifteenth (and final… for now) post of Mistakes Founders Make, a series of blog posts that shine light on legal mistakes that startups commonly make and attorneys have to fix. Keep in mind that the post sacrifices detail for simplicity and is for informational purposes only. ...

This is the fourteenth post of Mistakes Founders Make, a series of blog posts that shine light on legal mistakes that startups commonly make and attorneys have to fix. Keep in mind that the post sacrifices detail for simplicity and is for informational purposes only. It should not be taken as advice...

This is the thirteenth post of Mistakes Founders Make, a series of blog posts that shine light on legal mistakes that startups commonly make and attorneys have to fix. Keep in mind that the post sacrifices detail for simplicity and is for informational purposes only. It should not be taken as advice...

This is the twelfth post of Mistakes Founders Make, a series of blog posts that shine light on legal mistakes that startups commonly make and attorneys have to fix. Keep in mind that the post sacrifices detail for simplicity and is for informational purposes only. It should not be taken as...

This is the eleventh post of Mistakes Founders Make, a series of blog posts that shine light on legal mistakes that startups commonly make and attorneys have to fix. Keep in mind that the post sacrifices detail for simplicity and is for informational purposes only. It should not be taken...

This is the tenth post of Mistakes Founders Make, a series of blog posts that shine light on legal mistakes that startups commonly make and attorneys have to fix. Keep in mind that the post sacrifices detail for simplicity and is for informational purposes only. It should not be taken as...

This is the ninth post of Mistakes Founders Make, a series of blog posts that shine light on legal mistakes that startups commonly make and attorneys have to fix. Keep in mind that the post sacrifices detail for simplicity and is for informational purposes only. It should not be taken as...

This is the eigth post of Mistakes Founders Make, a series of blog posts that shine light on legal mistakes that startups commonly make and attorneys have to fix. Keep in mind that the post sacrifices detail for simplicity and is for informational purposes only. It should not be taken as...

This is the seventh post of Mistakes Founders Make, a series of blog posts that shine light on legal mistakes that startups commonly make and attorneys have to fix. Keep in mind that the post sacrifices detail for simplicity and is for informational purposes only. It should not be taken as...

This is the sixth post of Mistakes Founders Make, a series of blog posts that shine light on legal mistakes that startups commonly make and attorneys have to fix. Keep in mind that the post sacrifices detail for simplicity and is for informational purposes only. It should not be taken as...

This is the fifth post of Mistakes Founders Make, a series of blog posts that shine light on legal mistakes that startups commonly make and attorneys have to fix. Keep in mind that the post sacrifices detail for simplicity and is for informational purposes only. It should not be taken as...

This is the fourth post of Mistakes Founders Make, a series of blog posts that shine light on legal mistakes that startups commonly make and attorneys have to fix. Keep in mind that the post sacrifices detail for simplicity and is for informational purposes only. It should not be taken as...

This is the third post of Mistakes Founders Make, a series of blog posts that shine light on legal mistakes that startups commonly make and attorneys have to fix. Keep in mind that the post sacrifices detail for simplicity and is for informational purposes only. It should not be taken as...

This is the second post of Mistakes Founders Make, a series of blog posts that shine light on legal mistakes that startups commonly make and attorneys have to fix. Keep in mind that the post sacrifices detail for simplicity and is for informational purposes only. It should not be taken as...