This is the third post of Mistakes Founders Make, a series of blog posts that shine light on legal mistakes that startups commonly make and attorneys have to fix. Keep in mind that the post sacrifices detail for simplicity and is for informational purposes only. It should not be taken as advice — whether legal, tax, or other — and does not create an attorney-client relationship.

Just the basics

What’s the problem?

You mention the equity percentage you’re offering to a potential hire, but don’t couple that with the actual number of shares or options that this equals. Even worse, you put the equity percentage in your formal offer letter.

How bad is it?

Could get pretty bad. When your offer presents equity as a percentage, it begs the question: that percentage of what? The fully diluted capitalization? The issued and outstanding stock? If so, when? Even worse, these numbers are subject to change over time, and it’s not a rare instance that several months pass between the time equity is promised and when it’s actually granted. All this can lead to an honest but sticky dispute between the company and the hire.

How do I avoid this?

Have the stock power signed by the stock recipient (and the stock recipient’s spouse, if relevant) at the same time that the Stock Purchase Agreement is signed.You should make sure your hire fully understands the comp package, and that includes presenting the equity percentage along with the equity number. However, when it comes to official paperwork, let go of the percentage and speak only in absolute numbers.

What do you mean by “offering equity as a number”?

When you’re hiring a service provider (whether it’s an employee, consultant, or an advisor) and part of the comp package is equity (whether restricted stock, stock options, or other), you have two ways to present the equity component:

- As a percentage (for example, 0.25%),

- As a number (for example, 25,000 shares of common stock).

So what exactly is the mistake?

During the hiring process, founders often tell potential hires the percentage of equity that they’re offering. They may or may not back this up by telling the actual number of shares or options that that equals. Equity percentage takes precedence in the hiring conversation; equity number takes a back seat or is ignored altogether.

Matters get worse if this goes beyond a casual conversation and enters official paperwork: for example, an offer letter provides the equity being offered as a percentage and not as a number.

Why does this matter?

When you set a percentage, that begs the question: that percentage of what? If you’re offering 1% in equity, is that 1% of the fully diluted capitalization (FDC) of the company? If so, when – today or some time in the future? Or is this 1% of the issued and outstanding stock of the company? If so, then is it 1% of the issued and outstanding stock before or after the grant of the promised equity?

You see, with a percentage, you bring an unknown variable into the equation – that percentage of what? Unless you exactly specify that variable, you’re potentially setting yourself up for a dispute down the line.

Simply put, percentages are relative and numbers are absolute.

How is this a thing? Isn’t it common practice to base percentages off of fully diluted capitalization?

Arguably, yes, it is – but fully diluted capitalizations change. I’ve encountered multiple examples of a startup promising equity to a hire and then not actually granting that equity for months or even years (a topic of a future post, mind). Over time, the fully diluted capitalization changes: preferred stock is issued, warrants are issued, the option pool is increased, etc. So when the time comes to actually grant the promised equity to the hire, assuming it was offered as a percentage and not as a number, it’s easy to see how this can lead to an honest but sticky dispute, where the company claims that the grant should be 1% of the FDC at the time of hire and the employee counters that it should be 1% of the FDC at the time of grant.

I see what you’re saying, but a percentage gives so much information than a number in this setting.

You’re absolutely right. Tell a hire they’re getting 25,000 shares, and they won’t be sure how to feel about that number. Tell them they’re getting 0.25%, and they’ll have a better understanding of where they stand in the big picture.

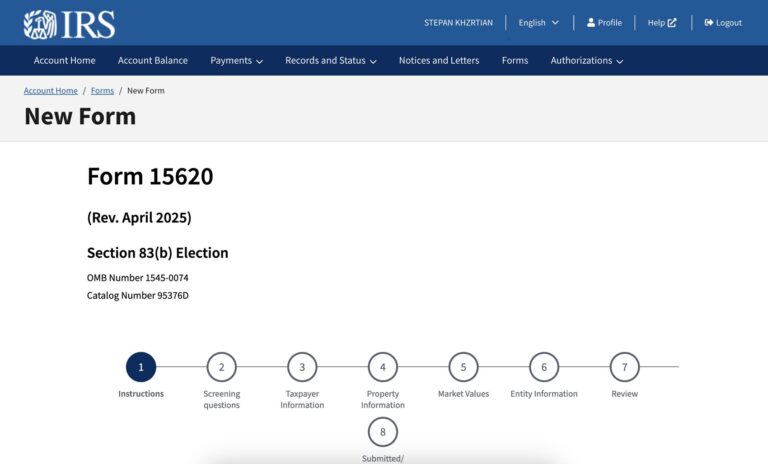

It’s your job as a founder to make the comp package super-clear for your hire and so, by all means, mention the equity percentage verbally when making the offer. You have some leeway in casual email correspondence as well, where you should focus on the number, but can follow that with a clear specification of the percentage (something along the lines of “25,000 shares of common stock, equal to 0.25% of the fully diluted capitalization today, November 17, 2022”).

All that being said, in official correspondence, and especially in the actual offer letter, state the equity number only, and make sure that your offer letter says that it takes precedence over anything else you’ve discussed previously, whether verbally or in writing.