S Corp Election

Made Simple

Complete your Form 2553 from start to finish.

We handle everything – from document preparation and signature collection to IRS shipping and tracking.

Save Time

Form completion with auto-validation ensures accuracy and prevents common mistakes

Ensure Compliance

Built-in rules and IRS-compliant shipping procedures to meet requirements and deadlines

Streamlined Signatures

Easy-to-follow process for collecting required physical signatures from shareholders

Shipping & Tracking

IRS-compliant USPS or FedEx shipping with real-time tracking updates

How It Works?

Input Company Information

Enter your corporation details with our simple form that guides you through each required field

Collect Signatures

Follow our video guides and clear instructions to properly collect and upload required physical signatures

We Handle Shipping

Your documents are shipped via USPS or FedEx according to IRS-mandated procedures with full tracking visibility

Track and Complete

Monitor your filing status and receive notifications throughout the process

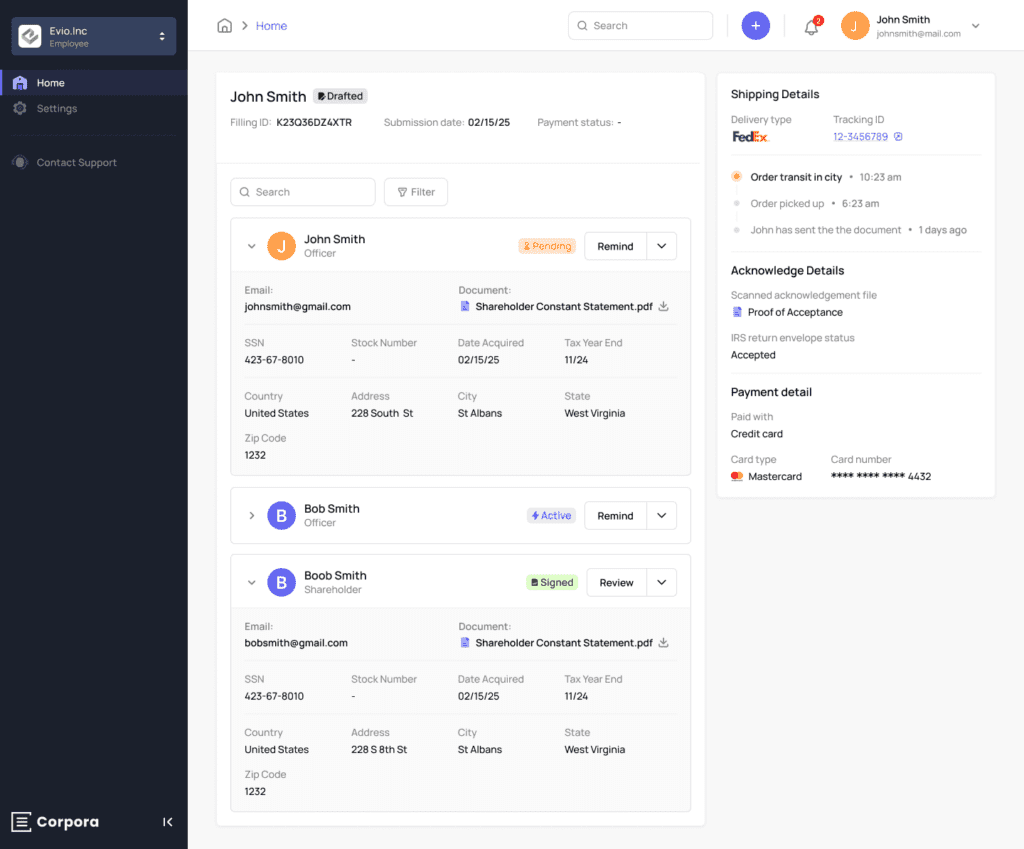

Online filling

Streamline your S Corp election filling.

- Guided information collection

- Signature collection

- Automated reminders

- Admin dashboard

- Tracking number & notifications

- Guides and tutorials

Everything you need to know about S Corp Election

Intro

There’s a reason why S Corps are so popular as a type of business structure – they avoid the double taxation that comes with being a “regular” corporation (aka, a C Corp), while still enjoying limited liability.

However, there’s so much more to it.

What is an S Corp? Why should you become one? How do you become one?

And why is it called S Corp anyway?

We break it all down here.

Let’s go.

What is an S Corp?

An S Corporation (or “S Corp”, for short) is a “tax designation” – a special way for a business entity to be taxed. When a business entity makes a successful S Corp election, it elects to not pay federal income tax on company income.

You read that right: by making an S Corp election, a company can end up paying less tax.

Nope, this isn’t a trick scheme – the S Corp election is filed with the IRS, and it’s the IRS that agrees to waive levying federal tax on the company’s income.

Wild, no?

Instead, the company’s income, losses, deductions, and credits pass through to the owners of the S Corp entity. The owners then report the flow-through of income and losses on their personal tax returns and are assessed tax at their individual income tax rates.

As a result, the electing company avoids double taxation.

What’s double taxation?

Avoiding double taxation – sounds nice, right?

But… what is it?

Double taxation can mean different things depending on the context, but the essence is the same: the same income is taxed twice. For example, if you’re a U.S. tax resident that’s renting out a home overseas, the rent you collect might be taxed by the country where your home is located and by the U.S. As a result, the rent is taxed twice – or subject to double-taxation.

(In fact, stateside it might be taxed on a federal level and on a state level – talk about “triple taxation”!)

In relation to S Corps, double taxation refers to income being taxed on the company level and the owner level. Allow me to explain.

Double taxation: company-level and owner-level

In the case of “regular” corporations (C Corps), corporate income is taxed on two levels:

1. The company pays tax on its corporate income.

Then, if and when whatever’s left of the corporate income is distributed to shareholders:

2. The shareholders pay tax on their personal income.

Let’s add some numbers:

- A company has $1M in profits in 2024. It pays 20% corporate income tax on that amount, or $1M x 20% = $200K.

- After corporate income tax, the balance is $1M – $200K = $800K.

- That $800K is then distributed to a sole shareholder.

- The shareholder then pays 35% personal income tax on the distribution she received, or $800k x 35% = $280k.

- The shareholder is left with $800k – $280k = $520k.

So, the total taxation on both the corporate income and the personal income is:

- Corporate income tax = $200k

- Personal income tax = $280k

- Total tax = $200k + $280k = $480k

And there you have it: double-taxation at its finest.

Flow-through taxation

The antonym of double taxation in this context is “flow-through taxation”. Rather than first being taxed at the company level, the company’s income “flows through” the company level and is instead only taxed at the owner-level.

In other words:

The company pays tax on its corporate income.- The shareholders pay tax on their personal income.

And to add numbers based on the scenario above:

- A company has $1M in profits in 2024.

- It distributes all of its profits – all $1M of it – to its sole shareholder.

- The shareholder then pays 35% personal income tax on the distribution she received, or $1M x 35% = $350k

Corporate income tax on company profits is no longer due. As a result, instead of paying $480k in total tax in the double taxation scenario, the total tax in this flow-through scenario is $350k, or $130k less.

Keep in mind, though, that we’re only talking about federal tax here.

So, to close the loop: by electing to be taxed as an S Corp, business entities are opting for flow-through taxation instead of double taxation.

What are some other benefits of S Corps?

Along with avoiding double taxation, S Corps can also help reduce your tax burden in two other ways:

- tax savings on self-employment compensation,

- Applying business losses to other personal income.

Let’s dive into each in turn.

Tax savings on self-employment compensation

If you’re running a small business, you’re likely self-employed – that is, you’re both the owner and the manager of that business (and, possibly, even the only employee).

And, obviously, you want to get paid.

If you’re set up as an LLC where you’re the member and manager, all the net earnings of that LLC is going to be allocated to you as your personal income – and be subject to self-employment tax of 15.3%. In fact, 7.65% of your net earnings are going to be exempt from self-employment tax, so only 92.35% of it will be subject to the self-employment tax.

If, instead, you’re set up as an S Corp (even if you’re an LLC that has elected to be treated as an S Corp), then instead of having to treat all of the company’s net earnings as a distribution to you, you can break down that compensation into two elements:

- a reasonable salary, and

- a distribution (think, a dividend).

In this instance, only your reasonable salary will be subject to the 15.3% self-employment tax. The balance – the distribution element – will be free from self-employment tax.

Let’s add some numbers to make this more tangible.

- Your business has $150,000 in net earnings.

- If you were to set a reasonable salary, it would be $65,000/year.

If you’re self-employed as the member-manager of an LLC that is not an S Corp, here’s the breakdown of your taxes:

Business net earnings | $150,000 |

Exempt from tax (7.65%) | $11,475 |

Your taxable income | $138,525 |

Self-employment tax (15.3%) | $21,194.32 |

Take-home pay (includes the tax-exempt portion) | $128,805.70 |

If, instead, you’re self-employed as the member-manager of an LLC that is an S Corp, here’s the breakdown of your taxes:

Business net earnings | $150,000 |

Distribution (no self-employment tax) | $85,000 |

Your salary (subject to self-employment tax) | $65,000 |

Self-employment tax (15.3%) | $9,945 |

Take-home pay | $140,055.00 |

By making an S Corp election, this business owner ends up taking home an additional $11,249.30.

Applying business losses to other personal income

Above, we talked about how an S Corp helps you avoid double-taxation by having profits flow-through the company level and only be taxed at the personal level.

Well, not only do profits flow through, but also losses.

New businesses typically have losses in the initial period of operation – usually, for several years. With those losses flowing through to your personal tax return, you are able to apply them to income that you may be receiving from sources other than your new business. These losses would reduce your taxable income base, thus resulting in a lower tax burden.

Who can be an S Corp?

To qualify for S Corp status, an entity must meet certain requirements:

- Be a domestic corporation

- Have only shareholders that are individuals (or certain trusts and estates)

- NOT have nonresident alien shareholders

- NOT have shareholders that are partnerships or corporations

- Have no more than 100 shareholders

- Have only one class of stock

- Not be an ineligible corporation (i.e. certain financial institutions, insurance companies, and domestic international sales corporations)

Let’s take each of these in turn.

Be a domestic corporation

Only companies formed and resident in the U.S. can be an S Corp. By the way, although the rule refers to domestic corporations, it also covers domestic entities which are eligible to be taxed as a corporation (such as an LLC).

Have only shareholders that are individuals

In short, an S Corp may have only individuals as shareholders. Estates and certain trusts provided by law are also ok.

NOT have nonresident alien shareholders

What this essentially means is that only U.S. citizens and/or U.S. residents may be shareholders of an S Corp. An S Corp cannot be owned by a foreign citizen who is not a U.S. tax resident.

In all likelihood, the reasoning behind this is that since company income is only going to be taxed on the personal level, the IRS still wants to capture some tax on that personal income, which it can do only if the shareholder him/herself is a U.S. taxpayer.

NOT have shareholders that are partnerships or corporations

This loops back to one of the earlier points: only individuals can be shareholders of an S Corp. The reasoning behind this is likely to avoid S Corps with complex taxation structures and/or structures that abuse the benefits afforded by S Corp status.

Have no more than 100 shareholders

An S Corp may not have more than 100 shareholders. For purposes of counting, spouses or family members (and their estates) can be treated as one shareholder. The reasoning behind this is likely to ensure that only small companies can benefit from an S Corp status.

Have only one class of stock

You may have heard of Common Stock and Preferred Stock. Well, for an S Corp, there can only be one class of stock, and all shareholders can own only that kind of stock. This helps in ensuring equal treatment of S Corp shareholders and keeping the tax structure simple.

NOT be an ineligible corporation

Certain financial institutions, insurance companies, and domestic international sales corporations are not eligible to be an S Corp.

How do you become an S Corp?

First thing you want to do is ensure that you meet all the eligibility requirements listed above.

Once that’s squared away, your next step is filing IRS Form 2553.

Let’s break down some of the technicalities in this segment.

IRS Form 2553

Here’s what the IRS Form 2553: Election by a Small Business Corporation looks like:

While most of the fields are quite straightforward, you can find detailed instructions here. Additionally, we’ve flagged some key points that you should be aware of below.

Shareholder’s Consent Statement

It’s important to note that all shareholders (or owners) of the company have to be on board for the company to validly make an S Corp election. After all, this election will be affecting all the shareholders’ taxes, and everybody has to be aligned that they’ll be treating company income and any distributions from it the same way for tax purposes.

Shareholders provide this consent by signing Form 2553.

Deadline to file

By default, the company has to complete and file Form 2553:

- No more than 2 months and 15 days after the beginning of the tax year the election is to take effect, or

At any time during the tax year preceding the tax year it is to take effect. - In other words, if a company wishes to be taxed as an S Corp in 2026, it has until March 15, 2026 to file Form 2553. Alternatively, it can make the filing any time in 2025.

Shareholders provide this consent by signing Form 2553.

And if you’re a newly formed company?

Well, then you have 2 months and 15 days from your date of formation to file Form 2553 if you want to be taxed as an S Corp right from the get-go. So, if your formation date is March 2, 2025, you have until May 16, 2025 to file Form 2553 to be treated as an S Corp for your first (short) tax year of 2025.

How did you count that deadline?

Here’s the official guidance from the IRS on how to count two months:

[T]he 2-month period begins on the day of the month the tax year begins and ends with the close of the day before the numerically corresponding day of the second calendar month following that month. If there is no corresponding day, use the close of the last day of the calendar month.

So, if the formation date is March 2, 2025, then 2 months from that day is NOT May 2, 2025, but a day prior to that, or May 1, 2025. Then add 15 days to that, and you get a deadline of May 16, 2025.

Late election

Missed the 2-months-and-15-days deadline? Fret not, you still have an option to make a late election, assuming you satisfy a number of requirements.

How late, you ask?

3-years-and-75-days late.

Here are the requirements you need to meet to request a late election:

- The corporation intended to be classified as an S Corp as of a given date provided on Form 2553 (let’s call that the S Corp effective date).

- You failed to qualify as an S Corp on that effective date only because Form 2553 wasn’t filed by the default deadline.

- You have reasonable cause for failing to file Form 2553 on time and you’ve acted diligently to correct that mistake when you discovered it.

- Form 2553 is being filed no later than 3 years and 75 days of the intended effective date.

- Assuming you meet requirements (1) through (4), your shareholders also need to confirm that they’ve reported their income on all affected returns consistent with S Corp status for all tax years since and including the intended effective date.

If you’ve met requirements (1) through (3), but not (4) – that is, you’re past even the 3-years-and-75-days deadline (wow, you’re so late) – you can still request a late election if:

- The company and all its shareholders reported their income consistent with S Corp status for all tax years since and including the intended effective date.

- At least 6 months have passed since the date the company filed its tax return (Form 1120-S) for the first year it intended to be an S Corp; and

- Neither the company nor any of the shareholders was notified by the IRS of any problem regarding the S Corp status within those 6 months.

Note that these are a general overview of the requirements. If you’d like more detail, check out Form 2553’s instructions and Rev. Proc. 2013-30.

How do you file a Form 2553?

There are a few peculiarities you should know about filing Form 2553 so that you not only get it right, but also have proof to show that you filed the form in case it gets lost or misplaced. We cover those nuances in this segment.

How to file

Here’s the pickle: unfortunately, Form 2553 cannot be filed electronically; it must be mailed and/or faxed. That means preparing a hard copy of Form 2553, stuffing it in an envelope, and send it off to the correct IRS address using the correct type of mailing service. Alternatively, you can fax in the form, although it’s commonly recommended to not rely solely on fax.

Additionally, to make things even more difficult, Form 2553 must bear a “wet signature” – that is, an ink signature as opposed to a digital one. While the IRS is in the process of modernizing signature requirements and accepting electronic signatures in certain cases (such as the 83(b) election), Form 2553 is yet to be afforded that benefit. Until then, the representing officer of the company and its shareholders must put their pens to paper in signing their name.

What carrier service to use

Ok, we now know that you can’t e-file your Form 2553 – it has to be mailed or faxed in. But when it comes to mailing it in, not all mail services are created equal. Sure, you can put your form in an envelope, place a stamp on it, and drop it in an outgoing mailbox. However, by doing so, you won’t be collecting any substantive proof that you actually made the S Corp election on time.

Instead, send out your form using one of these two carrier services:

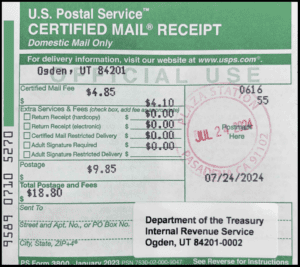

USPS Certified Mail

Using USPS Certified Mail gives you three benefits:

- Timely mailing treated as timely filing: this means that so long as the day you mail your filing is on or before the last day to file, you’ve met the deadline – regardless of when the filing is actually delivered.

- Legal proof of mailing: you will have documented proof that will hold up in court in case there’s an issue of whether you actually sent your filing.

- Prima facie evidence of delivery: if the filing gets lost or misplaced at some point, having used USPS Certified Mail serves as a rebuttable presumption that it was, in fact, delivered.

However, to enjoy these benefits, make sure you obtain a “postmarked certified mail sender’s receipt” which looks like this:

IRS-designated Private Delivery Service (PDS)

Alternatively, you can send your filing using a private delivery service, such as DHL, FedEx, or UPS. However, make sure you use one of their IRS-designated services.

DHL Express | FedEx | UPS |

DHL Express 9:00 | FedEx First Overnight | UPS Next Day Air Early A.M. |

DHL Express 10:30 | FedEx Priority Overnight | UPS Next Day Air |

DHL Express 12:00 | FedEx Standard Overnight | UPS Next Day Air Saver |

DHL Express Worldwide | FedEx 2 Day | UPS 2nd Day Air |

DHL Express Envelope | FedEx International Next Flight Out | UPS 2nd Day Air A.M. |

DHL Import Express 10:30 | FedEx International Priority | UPS Worldwide Express Plus |

DHL Import Express 12:00 | FedEx International First | UPS Worldwide Express |

DHL Import Express Worldwide | FedEx International Economy |

This is because only use of these designated services will allow you to benefit from that same “timely mailing treated as timely filing” rule that is afforded by USPS Certified Mail.

Where to file

As mentioned above, Form 2553 must be sent to the IRS by mail and/or fax. The actual address or fax number to be used depends on the state where the corporation’s principal business, office, or agency is located. Here’s a list that’s effective as of February 27, 2025. For an up-to-date list, make sure you check out this link.

If the corporation’s principal business, office, or agency is located in… | Use the following IRS Center address if you’re sending your Form 2553 via USPS: | Or use this fax number |

Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, Wisconsin | Department of the Treasury Internal Revenue Service Kansas City, MO 64999 | Fax: 855-887-7734 |

Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, Wyoming | Department of the Treasury Internal Revenue Service Ogden, UT 84201 | Fax: 855-214-7520 |

Instead of using USPS, you can also use one of the IRS-designated private delivery services. If you do so, make sure you use the address below (as opposed to the ones above). The fax numbers are the same.

If the corporation’s principal business, office, or agency is located in… | Use the following IRS Center address if you’re sending your Form 2553 via an IRS-designated private delivery service: |

Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, Wisconsin | Austin – Internal Revenue Submission Processing Center 333 W. Pershing Kansas City, MO 64108 |

Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, Wyoming | Ogden – Internal Revenue Submission Processing Center 1973 Rulon White Blvd. Ogden, UT 84201 |

(Other) Frequently Asked Questions

Can an LLC be an S Corp?

Yes! An LLC that otherwise satisfies the eligibility requirements for being an S Corp can make the election by filing Form 2553 and, thus, be treated as an S Corp.

As an LLC, do I need to file Form 8832 to be an S Corp?

No, an LLC that timely elects to be an S corporation (that is, timely files Form 2553) is deemed to have made an election to be classified as an association taxable as a corporation, assuming that it otherwise satisfies the requirements to qualify as an S Corp, thus obviating filing Form 8832. See Treas. Regs. Section 301.7701-3(c)(1)(v)(C).

When will the IRS get back to me?

It typically takes 60 days from the receipt of your filing for the IRS to respond to your S Corp election. If you file during tax season, there may be potential delays.

If box Q1 in Part II is checked, you’ll receive a ruling letter from the IRS that either approves or denies the selected tax year, which will generally add another 90 days to the wait.

If you haven’t received a response from the IRS within 90 days of filing – or within 5 months in case box Q1 in Part II is checked – you may want to follow up with the IRS at 1-800-829-4933 (Business & Specialty Tax Line).

How will the IRS get back to me?

The IRS Service Center where you sent your Form 2553 will send you a letter at the address provided on the form, typically containing one of three responses:

Acceptance Letter (CP261 Notice), approving your S Corp election,

Rejection Letter, providing the reason for rejection,

Request for more information, particularly if your Form 2553 is incomplete or contains errors.