This is the ninth post of Mistakes Founders Make, a series of blog posts that shine light on legal mistakes that startups commonly make and attorneys have to fix. Keep in mind that the post sacrifices detail for simplicity and is for informational purposes only. It should not be taken as advice — whether legal, tax, or other — and does not create an attorney-client relationship.

This is the second part of a two-part mini-series on 83(b) elections. In the first part, we talked about why you, as the stock recipient, should make an 83(b) election. In the second part, we’ll take about why your company should actually encourage stock recipients to make the election.

Just the basics

What’s the problem?

Your company issues restricted stock subject to vesting to an employee. If the employee does not make the 83(b) election, you would have to keep track of the fair market value (or “FMV”) of your stock for your accounting and tax purposes. This can become an administrative hassle for you.

How bad is it?

Medium. Unlike in the case of the employee, there’s no irreversible consequence for the company if the stock recipient decides not to file the election.

How do I avoid this?

Inform your stock recipients of the ins and outs of the 83(b) election, make it super-simple for them to file the election, and encourage (but do not push) them to make the election. If they make the election, obtain and retain a copy if it. If they do not make the election, obtain and retaining a signed letter from them saying that they had the chance to look into the matter and decided not to make the election.

What’s an “83(b) election”?

If the fundamentals of the 83(b) election are unfamiliar to you, I suggest you first check out the first part of this mini-series. It explains what the 83(b) election is, when it applies, and the tax implications involved.

Ok, I see why filing an 83(b) election is important for those who are getting stock. But how is it important for the company giving the stock?

Let’s look at the scenario where the stock recipient does not file the 83(b) election. In this case, they’ll pay ordinary income tax on the stock as it vests, based on the fair market value it has when it vests.

What this means for the company is determining the fair market value (or “FMV”) of the stock at each vesting point. Past the one-year cliff, this means determining the FMV each month, since that’s when the stock starts vesting monthly. Needless to say, this involves significant administrative hassle.

Further, knowing the FMV is important not only for the stock recipient its tax purposes, but for the company as well for its own tax purposes. The stock recipient is getting the stock as compensation — as income for their work. Your stock, just like your salary, is a deductible business expense for the company and also gives rise to certain withholdings by the company.

So when the stock recipient makes the 83(b) election, it keeps things simple?

Exactly, and significantly so. When this election is made, any tax obligations due to the receipt of stock are taken care of all at once, in the year the stock is granted, and at the FMV at which it is granted. This keeps things simple for the company as well, since it won’t have to track changes in the FMV over time and take it into account in its own tax reporting and withholdings.

What should the company do when it comes to 83(b) elections?

- Inform your stock recipients of what an 83(b) election actually is. You’re welcome to share the first part of this mini-series as a primer.

- Make sure they understand that they have 30 days to make this election. It’s a hard-and-fast rule. You use it or you lose it forever.

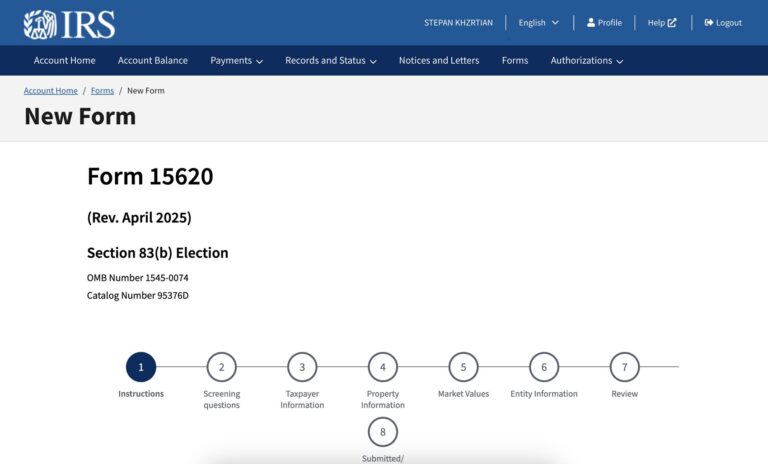

- Make it super-simple for your stock recipients to make the election. This means giving them the respective template and instructions along with their stock agreement.

- Consider sending them a couple reminders about the looming deadline. Those 30 days go by fast, and it’s easy to let this action slip through the cracks.

- Encourage them to actually make the election. Explain the benefits involved and the limited downside, especially in the early stages of the company’s life.

As you take these actions, it’s important to keep in mind and also to make clear for the stock recipient that the ultimate decision to make the 83(b) election lies with them. They are solely responsible for educating themselves about this election, the consequences involved with making the election or refraining from it, and actually filing the documents if they so decide. All of the actions mentioned above are done as a courtesy to your stock recipient.

What if the stock recipient doesn’t want to make the election?

The decision is ultimately theirs. While you should encourage them to make the election, you should not push them to do it because, if things go south, they may make the case that your company is partly reliable for the consequences.

Instead, request a signed letter confirm that they’ve had the opportunity to talk with competent counsel and they’ve decided that they do not want to make the 83(b) election.

Anything else to keep in mind?

If someone has the option to make the 83(b) election, then you need to get one of two documents from them: either a copy of their filed election or a signed writing saying that they’ve decided not to make the election.