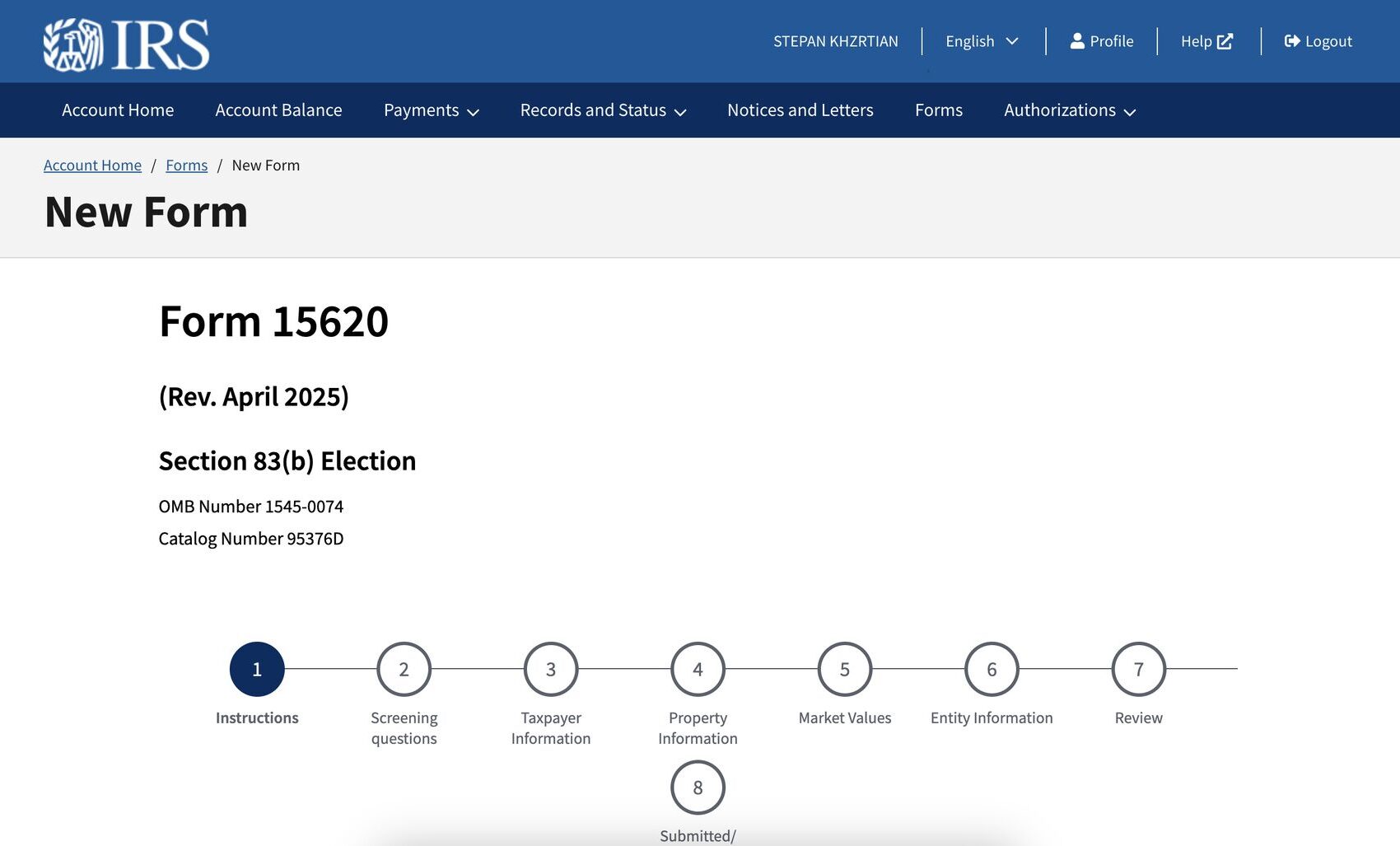

IRS Launches Electronic 83(b) Election Filing: Pros, Cons, and What You Need to Know

📣 Finally, the day has come! The IRS now accepts 83(b) elections electronically. ⚡ Taxpayers may continue mailing in their form if they’d like. (𝘉𝘶𝘵 𝘸𝘩𝘺 𝘸𝘰𝘶𝘭𝘥 𝘺𝘰𝘶?! 𝘙𝘦𝘢𝘥 𝘰𝘯 𝘵𝘰 𝘧𝘪𝘯𝘥 𝘰𝘶𝘵). A few months ago, the IRS released an official form for making a Section 83(b) Election – 𝗙𝗼𝗿𝗺