Not providing a vesting schedule

This is the fourteenth post of Mistakes Founders Make, a series of blog posts that shine light on legal mistakes that startups commonly make and attorneys have to fix. Keep in mind that the post sacrifices detail for simplicity and is for informational purposes only. It should not be taken as advice — whether legal, tax, or other — and does not create an attorney-client relationship.

Just the basics

The company grants equity to a founder or a service provider without providing a vesting schedule: a timeline based on which that equity can be taken back by the company.

Without a vesting schedule, the equity recipient becomes the full owner of that equity from day 1. If the equity recipient quits or is fired the next day, their equity is theirs to keep. For perspective, this is like paying several years of salary to a newly hired employee on the day they join the company, and if they leave the very next day, they get to keep that oversized paycheck.

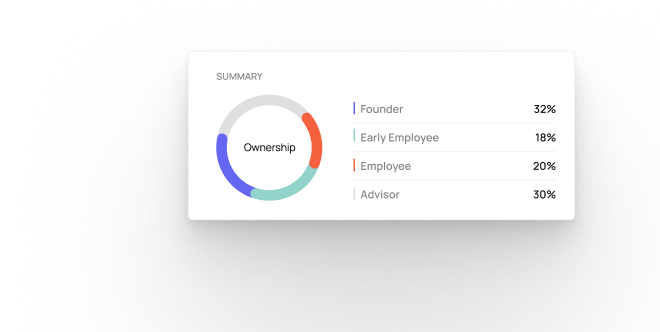

For every grant of equity — whether in the form of restricted stock or stock options — have a vesting schedule in place. Four-year vesting with a one-year cliff is customary for founders, employees, and consultants, whereas two-year vesting is customary for advisors.

What is a "vesting schedule"?

First off, let’s clarify when vesting schedules are relevant. In a startup setting, they’re mainly relevant for stock (in which case they’re commonly known as “restricted stock”) and stock options. If stock or stock options have a vesting schedule (in order words, if they are “subject to vesting”), it means that the company that granted this equity can take it back from the recipient.

Coming to your question: the vesting schedule is the timeline based on which the company’s right to take back some or all of the equity expires.

I think I get it, but could you give me examples?

Sure. You may have heard of four-year-vesting with a one-year cliff. That’s a type of vesting schedule which is common for founders, employees, and consultants. Another vesting schedule is two-year vesting, which is common for advisors.

Let’s assume the company has granted 24,000 options with a two-year vesting schedule, starting on January 1, 2023. This means that on each monthly anniversary (or should I say monthiversary?) of January 1, 2023, the company loses its right to take back 1,000 options. So, on May 1, 2023 — which is four months after January 1, 2023 — the company would have lost its right to take back 4,000 options. Those options will be considered “vested,” and the remaining 20,000 options will be considered “unvested.”

Why 1,000 options?

Since the example is for a two-year vesting schedule and two years is equal to 24 months, the 24,000 options will be earned over the course of 24 months — or 1,000 options per month.

When you say "company loses its right to take back equity," what exactly do you mean?

In the case of options, this means that the optionholder (the person who received the options) can exercise the “vested” options. They won’t be forfeited when this person leaves the company until they’ve had the chance to exercise the options.

In the case of restricted stock, this means that the stock recipient gets to keep the vested stock and the company cannot repurchase them.

Understood. So what's the problem here?

Say, you hired an employee with an annual salary of $60,000. Over four years, the total salary would be $240,000. Now, assume you paid that entire $240,000 to your employee the day they started working for your company. They worked for you for a few months, decided to quit (or you terminated them), and now you can’t take back that $240,000 payment.

Sounds very unreasonable, right?

Well, it’s a similar situation with equity that is not subject to vesting. In the absence of a vesting schedule, the equity recipient will receive all of their equity at once, on the day they join your company… and will get to keep all of it even if they leave your company (or you decide to terminate them) early.

Even if they quit the very next day after joining your company.

Yikes! Does this problem happen often?

For founders who haven’t done their homework before setting up a company, yes — and it usually comes up in the form of founder conflicts. A few months into the business, the founders have a falling out and one of them decides to leave, taking their entire stock with them. After that, the company has a chunk of equity that’s locked up with the ex-founder that is no longer contributing to the company, and the company has no right to force the ex-founder to return the “unearned” equity.

Needless to say, this normally results in the de-motivation of the continuing founder, the unattractiveness of the company for investors, and, ultimately, the untimely demise of this botched enterprise.

Stepan Khzrtian is a corporate attorney with over 10 years of experience helping startups with their legal needs, including corporate formation, financing rounds, equity issuances, personnel matters, contracts, acquisitions, and intellectual property. His clients have ranged from pre-seed to pre-IPO companies. He is the co-founder and CEO of Corpora, Inc.