File your 83(b) election with Corpora

We are excited to team up with Teknos Associates to bring streamlined 83(b) election filings to you.

Enter your discount code upon checkout to claim the discounted rate.

“Partnership-related quote”

Name, Title

Once you place your order we will:

Markets Served by Teknos

- Information Technology

- Life Sciences and Biotechnology

- Alternative Energy and Cleantech

- Blockchain Technology and Cryptocurrency

- Esports and Gaming

- Other Emerging Growth

- Venture Capital and Private Equity

Teknos Services for Corpora Clients

Corporate Advisory Services

The team at Teknos can help you to effectively understand and mitigate some of the most pressing challenges facing your organization thanks to decades of first-hand experience and a wealth of professional knowledge developed and honed across engagements with hundreds of companies.

Tax Compliance and Financial Reporting Valuation Services

As auditors and regulatory institutions intensify their scrutiny on accounting and tax practices, its imperative for companies to develop fair value and tax-related valuation estimates utilizing objective analyses.

Litigation Support and Expert Witness Testimony

Individuals at Teknos have provided litigation support for some of the largest companies and leading law firms in Silicon Valley. We have withstood Daubert challenges. And we can help a judge or jury understand complex technology and valuation issues by taking the discussion beyond theory with real-world experience and practical examples.

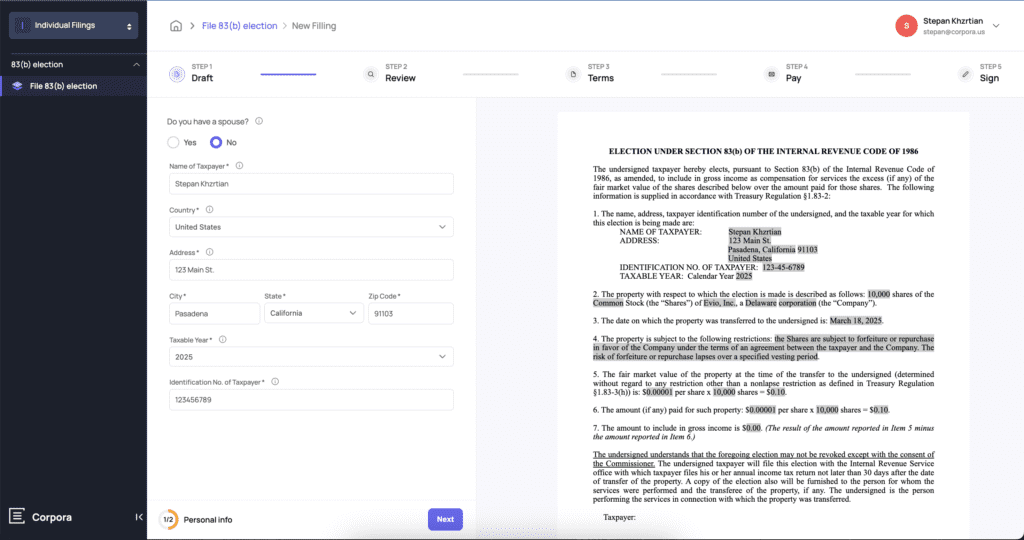

File your 83(b) Election with Corpora

FAQs

An 83(b) election is a tax document you file with the IRS, electing to pay tax on your equity grant at its fair market value on grant rather than at vest.

We treat each and every 83(b) election order we receive as if it were our own. We prepare the envelope, send it to the IRS, and track it as if we were doing this for our own shares in Corpora.

We make it a point to send out your 83(b) election by the next business day after it is finalized (you’ve drafted, reviewed, and fully signed it).

We got you covered. The protocol we use to send your 83(b) election acts as evidence that your 83(b) election is delivered to the IRS even if it isn’t actually delivered (for example, gets lost in the process). That said, please note that we are not responsible for matters beyond our control, such as lost items.

Yes. We carry Errors & Omissions and cybersecurity insurance policy with $1,000,000 limit.

21 days from the date of transfer of your equity. This allows us time to reach out to you in case there are problems with your submission. After the 21-day cut-off, we’ll be unable to process your 83(b) election.

No. The accuracy of your 83(b) election is entirely your responsibility. Any comments we share with you regarding your 83(b) election are provided as a courtesy, and it’s entirely up to you whether you take our comments into account or not. Please check out our terms.

No. Our role here is purely technical – after you sign your 83(b) election, all we do is print it out, send it to the IRS, and keep track of it. Also, if and once we receive the IRS date-stamped copy of your 83(b) election, we’ll upload a scanned copy to your account. Please check out our terms.