File your

83(b) Election Online

Individuals

For grant recipients who need to file once.

- Freeform statement or Form 15620

- No sign up necessary

- Get email tracking

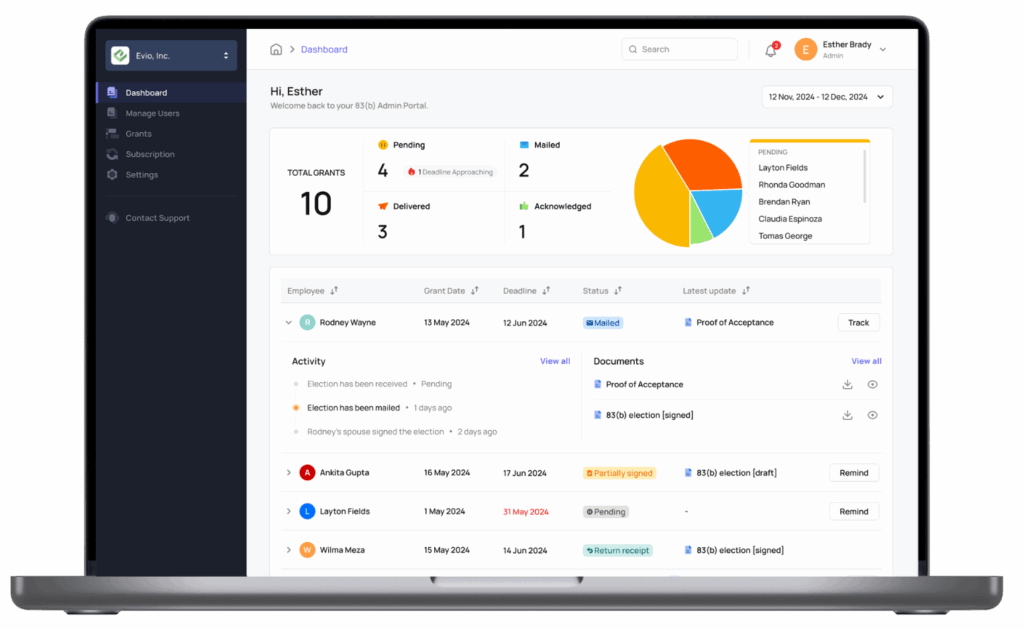

Corporate

For companies that have ongoing filing needs.

- Bulk draft 83(b) elections

- Automated reminders to employees

- Secure record-keeping

Trusted by thousands of filers at these companies:

Why trust Corpora

SOC 2 Type ||

Corpora is SOC 2 Type II certified. To learn more about our security measures, access our Trust Center, hosted by Vanta.

8,000+

83(b) elections processed

100%

Success rate for timely fillings

Next Day

Orders processed next business day

Our founders have decades-long expertise in high-stakes, enterprise-facing environments.

Stepan Khzrtian

Co-founder & CEO

10+ years corporate attorney, having served 100+ companies, from pre-seed to enterprise.

Serop Serop

Co-founder & CPO

10+ years tech executive, overseeing the development of enterprise-grade software for governments.

Supported use cases

Corpora helps you file an 83(b) election for virtually all relevant property types:

From our customers:

"I love how Corpora takes the headache out of filing your 83(b). I was almost late in filing mine, but Corpora was incredibly helpful and made sure I didn’t have to worry. They got it in on time! Highly recommend to all founders!"

"Every's Corpora partnership allowed us to file our 83(b) election seamlessly—so much so that I barely remember the process! It took all the complexity out of the equation, making it effortless and stress-free. Highly recommend it for any founder who wants to ensure their filing is done right without any hassle"

"Corpora: The Best Solution for 83(b) Filing – Reliable, Affordable, and Stress-Free!"

"83B elections are essential for any exit of your company, and I was able to complete it with Corpora in a few minutes. It was very easy and gave me the peace of mind that it was done well during this time sensitive window to file. I highly recommend everyone this apply to use Corpora to get the job done."

"I was dreading all the steps involved in properly handling 83(b) filings and mailing everything to the IRS, but Corpora made it incredibly easy. I’ve used them twice now, and the second time, the IRS actually lost my 83(b) form. What impressed me was how Stepan from Corpora reached out proactively, informed me about the issue, and provided several options to resolve it. I chose to resubmit, and they handled everything again. This time, they confirmed the IRS received the form and the filing was successfully processed. It’s rare to see such proactive support! I highly recommend Corpora for all your 83(b) filing needs—they’re fantastic!"

"Fast, easy, great management. They went above and beyond to make sure our 83(b) was filed correctly and on time. They even proactively contacted me to make sure that something that could have been a mistake I made was the correct information."

File yourself

No credit card required

Free

- Fill in the template online

- Downloadable file

Individual filings

One-time payment

Starting at:

$100

- Fill in the template online

- Sign electronically

- Tracking number & notifications

- Postage-paid return envelope

- IRS date-stamped copy (if received)

- 30-day storage

Volume filings

For companies and enterprise

Custom plans

Everything in “Individual filings” , and:

- Bulk drafting of 83(b) elections

- Admin dashboard for tracking 83(b) elections

- Customize the 83(b) election form

- Centralized user management

How it works:

Individuals

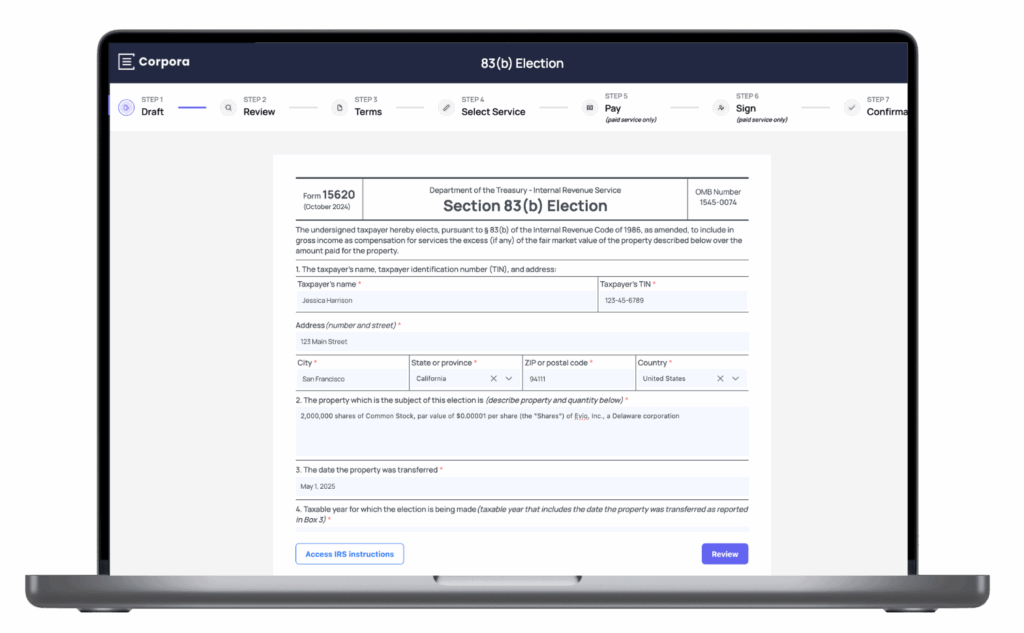

Draft

Fill out the necessary information through a guided, intuitive interface to reduce errors and save time.

E-sign

You (and your spouse, if relevant) sign your 83(b) election electronically.

Ship & track

Your signed 83(b) election is sent to the IRS by the book, and you receive tracking updates via email.

How it works:

Corporate

Bulk draft

Draft up to 1,000 83(b) elections and invite your employees to review and sign – in one click.

Automated reminders

Employees receive automated reminders to review and complete their 83(b) election.

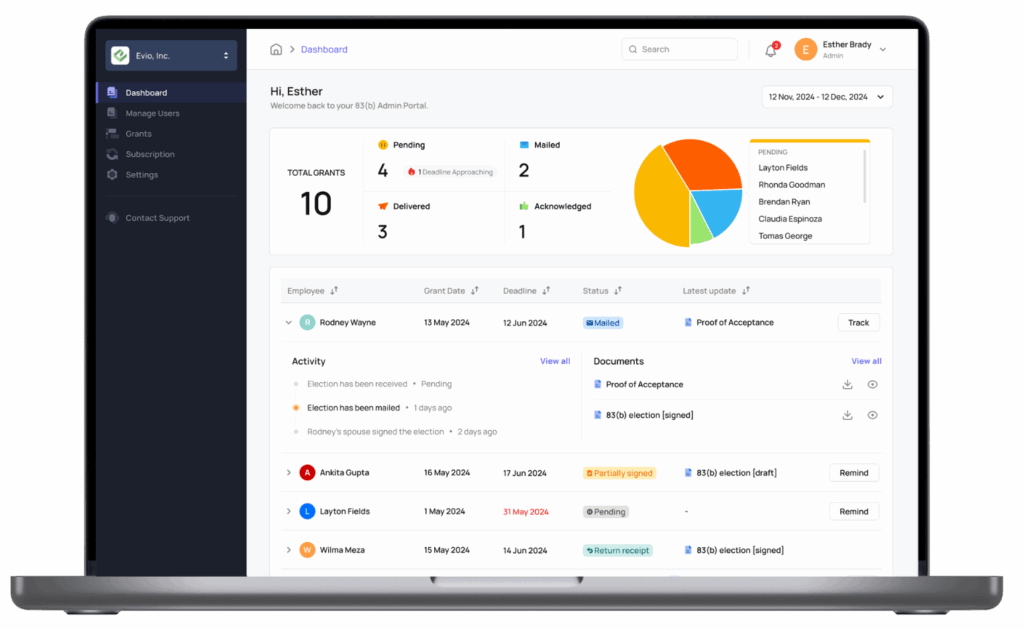

Admin dashboard

Gain visibility on the status of each 83(b) election filing and access related documents, which are securely stored.

Become a partner

Join over 20 vendors and professional consulting firms bringing streamlined 83(b) election filings to their clients and users.

- Branded landing page

- Discounted prices

- Customized features

- Custom onboarding

FAQs

An 83(b) election is a tax document you file with the IRS, electing to pay tax on your equity grant at its fair market value on grant rather than at vest.

We treat each and every 83(b) election order we receive as if it were our own. We prepare the envelope, send it to the IRS, and track it as if we were doing this for our own shares in Corpora.

We make it a point to send out your 83(b) election by the next business day after it is finalized (you’ve drafted, reviewed, and fully signed it).

We got you covered. The protocol we use to send your 83(b) election acts as evidence that your 83(b) election is delivered to the IRS even if it isn’t actually delivered (for example, gets lost in the process). That said, please note that we are not responsible for matters beyond our control, such as lost items.

Yes. We carry Errors & Omissions and cybersecurity insurance policy with $1,000,000 limit.

21 days from the date of transfer of your equity. This allows us time to reach out to you in case there are problems with your submission. After the 21-day cut-off, we’ll be unable to process your 83(b) election.

No. The accuracy of your 83(b) election is entirely your responsibility. Any comments we share with you regarding your 83(b) election are provided as a courtesy, and it’s entirely up to you whether you take our comments into account or not. Please check out our terms.

No. Our role here is purely technical – after you sign your 83(b) election, all we do is print it out, send it to the IRS, and keep track of it. Also, if and once we receive the IRS date-stamped copy of your 83(b) election, we’ll upload a scanned copy to your account. Please check out our terms.