The 83(b) election is arguably one of the most important tax forms to file if you received equity that is subject to vesting such as restricted stock or profits interests. 83(b) elections have saved taxpayers millions of dollars over the years, but there are some rigid rules involved with filing that can be a source of frustration – one of which is figuring out where to send your 83(b) election.

You Still Have to Mail It

While the IRS is making efforts to streamline the filing process, actually filing the 83(b) election is still not a painless process. There are two very important rules that the IRS absolutely requires, with no exceptions.

- You must file within 30 days of receiving the respective equity,

- You must mail in your 83(b) election

E-filing isn’t available (yet?)

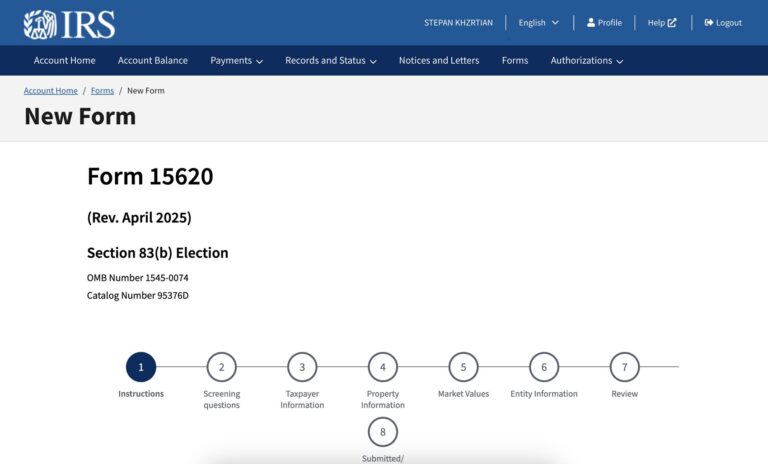

Unfortunately, the IRS has yet to create a way to submit your 83(b) election electronically. However, they have published a new form that taxpayers can use; Form 15620 was introduced earlier this month by the IRS in an attempt to streamline filing. Check out our complete analysis on the benefits and drawbacks of the new Form 15620, here.

When electronic submissions eventually become available, they will likely resemble Form 15620; until then, 83(b) elections will have to be submitted by mail.

However, if you would rather not do any of this, you can use our services and file with less hassle and headache because we will submit your 83(b) election for you at corpora.us.

Where do I file my 83(b) election?

Since you need to physically mail your 83(b) election, you need to know which is the correct address to send it to. The correct address depends on two main factors:

- Whether you’re using U.S. Postal Service or an IRS-authorized private delivery service

- Your state of residence – or if you’re residing overseas.

Here’s a nifty chart that you can use to determine the correct address based on these two factors. Following that is a more detailed discussion on how to use this chart. It’s current as of November 25, 2024.

| If you live in… | Use this address if you’re sending your 83(b) election via USPS: | Or use this address if you’re sending your 83(b) election via DHL, FedEx, UPS: |

| Alabama, Arizona, Arkansas, Florida, Georgia, Louisiana, Mississippi, New Mexico, North Carolina, Oklahoma, South Carolina, Tennessee, Texas | Department of the Treasury Internal Revenue Service Austin, TX 73301-0002 |

Austin – Internal Revenue Submission Processing Center 3651 S IH35 Austin, TX 78741 |

| Connecticut, Delaware, District of Columbia, Illinois, Indiana, Iowa, Kentucky, Maine, Maryland, Massachusetts, Minnesota, Missouri, New Hampshire, New Jersey, New York, Pennsylvania, Rhode Island, Vermont, Virginia, West Virginia, Wisconsin | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0002 |

Kansas City – Internal Revenue Submission Processing Center 333 W. Pershing Kansas City, MO 64108 |

| Alaska, California, Colorado, Hawaii, Idaho, Kansas, Michigan, Montana, Nebraska, Nevada, Ohio, Oregon, North Dakota, South Dakota, Utah, Washington, Wyoming | Department of the Treasury Internal Revenue Service Ogden, UT 84201-0002 |

Ogden – Internal Revenue Submission Processing Center 1973 Rulon White Blvd. Ogden, UT 84201 |

| A foreign country, U.S. possession or territory*, or use an APO or FPO address, or file Form 2555 or 4563, or are a dual-status alien). | Department of the Treasury Internal Revenue Service Austin, TX 73301-0215USA |

Austin – Internal Revenue Submission Processing Center 3651 S IH35 Austin, TX 78741 |

How to Mail your 83(b) Election

There are two ways for sending your 83(b) to the IRS:

- U.S. Postal Service, or USPS,

- Private delivery service, or a “PDS”, such as DHL, FedEx, or UPS.

Note that depending on the service you use – USPS or a PDS – the address will be different. The address will also depend on your state of residence.

“Timely mailing treated as timely filing”

Two critical points:

- If you use USPS, make sure you use Certified Mail.

- If you use a PDS, make sure you use one of their IRS-designated services (more on this below).

This is critical because it allows you to benefit from the “timely mailing treated as timely filing rule.” This means that so long as you handed your 83(b) election to the USPS or PDS by the deadline, it’s deemed that you have filed your 83(b) election on time, regardless of when the IRS actually gets it. For more information on meeting the 30-day deadline, check out this post.

Mailing with USPS

If you’re using USPS to send in your 83(b) election, the address you would use is the same address where you would otherwise send your tax returns – your Form 1040 – if you were filing by paper (which is precisely nobody these days). That address depends on your state of residence. The IRS provides a helpful chart on this, and the table above provides a summary, current as of November 25, 2024.

Are You Overseas?

For those of you who live and work in another country but have equity in a company, we have good news, bad news, good news, and better news.

Good news is that you have equity in a U.S. company. The bad news is that you may have to worry about U.S. taxes now (check out this post for detailed guidance on whether the 83(b) election is relevant for you). The good news is that with the 83(b) election you can potentially save a fortune on taxes, and the better news is that you can use our service at corpora.us to file your 83(b) election much more easily and affordably than doing it yourself.

But, if your residence is overseas and you want to submit your 83(b) election yourself, make sure to send it to:

Department of the Treasury

Internal Revenue Service

Austin, TX 73301-0215

USA

That’s if you’re using USPS or a foreign country’s public mail service. Instead, you may want to use a PDS – private delivery service, such as DHL, FedEx, or UPS – to send in your 83(b) election, in which case you have to use a different address. This is because PDSs don’t ship to P.O.Boxes, which the previous address is. More on that next.

DHL, FedEx, and UPS

For those that would rather use a private delivery service, the IRS has designated certain services by UPS, DHL, and FedEx that meet the “timely mailing treated as timely filing” rule. Again, this rule allows taxpayers to meet deadline requirements so long as they hand over their filing to the PDS by the deadline, regardless of when the IRS actually receives it. You can see in the table below which services are specifically mentioned on the IRS website, here, as well as the chart below, current as of November 25, 2024.

| DHL Express | FedEx | UPS |

| DHL Express 9:00 | FedEx First Overnight | UPS Next Day Air Early A.M. |

| DHL Express 10:30 | FedEx Priority Overnight | UPS Next Day Air |

| DHL Express 12:00 | FedEx Standard Overnight | UPS Next Day Air Saver |

| DHL Express Worldwide | FedEx 2 Day | UPS 2nd Day Air |

| DHL Express Envelope | FedEx International Next Flight Out | UPS 2nd Day Air A.M. |

| DHL Import Express 10:30 | FedEx International Priority | UPS Worldwide Express Plus |

| DHL Import Express 12:00 | FedEx International First | UPS Worldwide Express |

| DHL Import Express Worldwide | FedEx International Economy |

Now, mind you, if you’re using a PDS, you have to send your 83(b) election to an address that’s different from the ones you use when sending your document with USPS. That’s because the provided USPS addresses are all P.O. Boxes, and PDSs don’t deliver to P.O. Boxes. So, how do you determine which address to send it to? Essentially, you have to send your 83(b) election to the IRS Service Center located in the same city where you would send your document had you used USPS.

We know, that’s a mouthful. That’s why we provided the cheat-sheet chart at the very top, to help you follow along. Find your location of residence in the first column, and then match it with the address in the last column. For current data, make sure you access the official IRS webpage at this link.

An Easier Way to File

Remember: when sending your 83(b) election to the IRS, the actual address you use depends on two main factors – the service you’re using (USPS or a private delivery service) and your state of residence or being overseas. It’s important to get this right to avoid delays or hiccups. Of course, you can also use our services at corpora.us, without having to worry if you’re sending your document to the right address.