This is the first post of Mistakes Founders Make, a series of blog posts that shine light on legal mistakes that startups commonly make and attorneys have to fix. Keep in mind that the post sacrifices detail for simplicity and is for informational purposes only. It should not be taken as advice — whether legal, tax, or other — and does not create an attorney-client relationship.

Just the basics

What’s the problem?

The stock power comes into play when the company needs to buy back any unvested stock from a terminated employee. The signed stock power is your employee’s consent to transfer the repurchased stock to your company. Without this signed document, you could potentially face a legal problem if a disgruntled ex-employee is uncooperative in handing back unvested stock.

How bad is it?

Could get pretty bad. If the stock power isn’t signed and the employee has been terminated on bad terms, you and your counsel will end up playing a guessing game on whether to (a) reach out to the stock recipient and ask for their signature to the Stock Power, which may give them ideas; or (b) simply let it slide, which means that the problem may blow up in the future.

How do I avoid this?

Have the stock power signed by the stock recipient (and the stock recipient’s spouse, if relevant) at the same time that the Stock Purchase Agreement is signed.

The what signed?

The Stock Power. Also known as the Assignment Separate From Certificate. But before I lose you to legal jargon, let me explain what that is.

A Stock Power documents the transfer of shares from a stockholder to someone else. In Startupland, it normally arises in the context of issuing stock to a service provider (could be a founder, an employee, etc.) that is subject to vesting, and the Stock Power is signed by the stockholder/service provider in favor of the company.

Why is this important?

Normally, to take someone’s property from them, you need to have their consent – and that consent is normally given through a signed writing.

When a company gives stock subject to vesting to a service provider, that stock becomes the service provider’s property from Day 1. If the service provider is terminated before the stock fully vests, the unvested part of it (which could be all of it) will have to go back to the company. In other words, it will have to be taken away from its owner.

For the company to do this, it needs the owner’s consent, and that’s what the Stock Power is.

Why not have the stock power signed later, when the service provider is terminated?

There are two main reasons for this:

- What if the service provider leaves on bad terms? Being terminated is not always (or ever?) pleasant, which leads to the fired service provider being uncooperative.

- By doing this in advance, the company has one less housekeeping task (although a critical one) to worry about in the future.

So, you might as well do this in the beginning, when the company and the service provider are on the same page, to save yourself a headache (and legal fees) down the line.

Isn’t this all in the Stock Purchase Agreement? Why sign more papers that all say the same thing?

Yep, it is in the Stock Purchase Agreement (or should be, at least).

But check this: the Stock Purchase Agreement provides the rules that the company and the service provider have to follow when it comes to transferring the stock back and forth. It provides the formula that should be used to determine how much stock is vested and unvested (the vesting schedule), but it doesn’t say exactly how much of that stock will actually be transferred by the service provider to the company – quite simply because nobody knows if and when the service provider will be terminated.

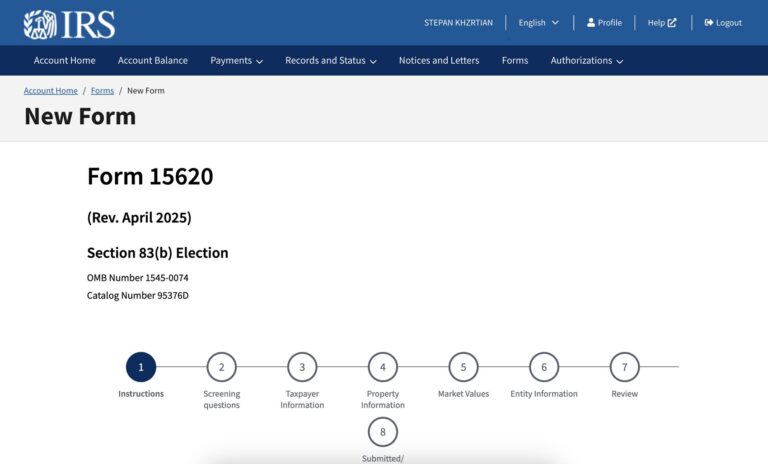

On the other hand, the Stock Power will establish the number of stock that is actually being transferred from the service provider back to the company. It will then serve as the document that the company uses to show that it had the service provider’s consent, in writing, to take that much stock back from the service provider.

I’m asking my new employee to sign a document which has blanks in it. Why? And how is that fair?

The Stock Power has blanks because nobody knows if and when the service provider will be terminated, and so how much of the stock will have to go back to the company. That’s why the date and the number of stock are left blank on the Stock Power.

To keep the company from abusing a blank signed document, the Stock Power says that it can be used only as allowed by the Stock Purchase Agreement. It limits how the company can use it to the explicit terms that the company and the service provider agreed to.