Legal: as a startup founder, it’s probably not your number one skill.

That’s normal. If you’re running a startup, you’re likely trained in another discipline. Think: computer science, marketing, finance or sales.

Legal is, understandably, an afterthought – you’re focused on building. But the law dictates how you organize and manage your company. Additionally, the regulatory landscape (also a product of the legal industry) often shapes important elements of your business, like your go-to-market strategy and how you handle your customers’ data. You could outsource everything that touches “legal” to a lawyer, but should you?

While delegation is a powerful tool (and you should, of course, take full advantage of it!), one thing that should not be completely outsourced to your legal counsel is “document management.”

——–

So that we’re on the same page, let’s define our key term. Document management refers to “the systematic organization, storage, retrieval and control of documents and information.” Amazon stores the products it ships across the universe (books, electronics, etc.) in warehouses. Legal service providers store the products they ship across the universe (contracts and other paperwork) in digital warehouses.

The digital warehouses that lawyers and law firms use to manage your documents are not user-friendly. But they still do it! Startup lawyers keep track of contracts, court filings, legal opinions, intellectual property filings and more on your behalf – for safe-keeping and easy access. But don’t assume that lawyers have mastered the skill of document management, search and retrieval. It’s hard stuff (!) and they’re figuring it out, just like you. The difference is this: lawyers who charge by the hour get paid to “manage” your documents; you, on the other hand, do not.

Below, we’ll explore the nuances of document management, shedding light on how startups can best work with lawyers and law firms to effectively manage their documents and – ultimately – to save money and take control of their paperwork.

I. Why Should Startups Care About Legal Documents?

As a startup attorney and fractional general counsel, these questions feel obvious to me. OBVIOUSLY legal documents are important. However, I’ve realized that many startup founders don’t care or don’t get it. Not only is the answer to “why should you care about legal documents” not obvious, but often, the question doesn’t even come up!

In your day-to-day, you’re most likely focused on team-building, product-building, fundraising and sales. That’s great (and it’s a lot)! To accomplish your goals in each of these areas, you’ll inevitably prepare and execute contracts to formalize certain relationships. With your employees and advisors, you’ll sign employment agreements. With your investors, you’ll sign financing agreements. And with your customers, you’ll sign a number of commercial agreements. Contracts (which are used to document legally-binding agreements between parties) are the core avenue by which you will “formalize” your company’s relationships with third parties.

Indeed, contracts and other legal documents will serve as the foundation and “source of truth” for your startup, whether you like it or not.*

*Many in the “move fast and break things” crowd might instead care only about their cap table (i.e., any document that outlines the ownership structure of a company). But ownership in a company isn’t established by the existence of an excel spreadsheet: it’s established via contract. In other words, a cap table is just a virtual representation of what is promised and contractually obligated pursuant to your company’s underlying documents. In turn, those documents set forth your company’s rights, obligations and relationships with employees, investors and partners.

There are several key reasons why you (and not just your lawyers) should be keeping track of your legal documents (and hence, why document management is critical for every startup). Let’s explore:

1. Documents Establish Legal Rights:

Contracts establish legal rights and obligations for the people and companies that are party to them. For example, if I promise to mow your lawn next Saturday in exchange for $100, and we sign a legally-valid agreement to that effect, I’m obligated – pursuant to the contract – to mow your lawn. Yes, it’s a free country, and yes, I am not generally obliged to mow the lawns of strangers, but I forfeited that right when I signed the contract. Now, if I fail to follow through on my promise next Saturday (i.e., my obligation), I will have “breached” our contract and I’ll be on the hook for any potential damages. This is how contracts work – each party provides “consideration” (the legal term to describe value conveyed under a contract) and makes certain promises on which they need to follow-through (or else!). The dynamic doesn’t change just because the contract gets more complicated. All of your contracts involve promises, conveyance of consideration and the potential for a material breach.

Most startups seeking venture capital investment are organized as Delaware c-corporations. Thus, the documentation needed to form a startup is quite predictable – this is why companies like @Clerky exist: because there is a formula of sorts to “incorporating” (i.e., forming) a startup.

The core documents in your startup from day one will be your articles of incorporation (also known as a “corporate ‘charter’”), your bylaws and your initial stock paperwork (signed by the founders of the company). These documents define the legal structure of the startup you create. You can think of these documents as a “constitution” of sorts for your company – they set the ground rules for your operations, including what kind of stock your company can offer (e.g., common v. preferred), who can transfer said stock and under what circumstances, how the Board of Directors is composed and more. In addition to these “constitutional” legal documents, you’ll be signing contracts with various parties that you do business with over time.

Collectively, the agreements you sign on behalf of your startup over time will establish the rights and responsibilities of your startup’s founders, officers, directors, stockholders, employees and investors. Without your formation paperwork (which is “filed,” or submitted, to the state in which you incorporate), your company doesn’t actually exist. And without contracts at each step of the way, the rights of the aforementioned parties are – at best – unclear and – at worst – fundamentally in doubt. Legal documents matter because they make things real. That’s the main reason you should care about them, but there are more!

2. Documents Define Ownership in Intellectual Property:

A second reason you should care about legal documentation at your company is IP. Legal is the core avenue through which you will protect IP created at your company. “Legal” and, therefore, your IP, is memorialized via documentation.

The most valuable asset at a startup is its people (i.e., its human capital). Second most valuable asset at a startup: its IP (i.e., the technology it creates and offers to the world). In the same way that you don’t have a company without your incorporation paperwork being filed with the state, you can’t have much assurance that your company owns the IP it creates without the correct legal paperwork first being put into place.

Documentation such as patent and trademark filings define IP ownership as it relates to certain inventions, logos and brands. Establishing legal ownership rights is important as you grow – you want to protect your (second) most valuable assets from infringement by third-parties and unauthorized use.

Additionally, it’s important to note that nearly everyone who works for your startup – whether an engineer or a marketing manager – is creating IP as they work.

IP is not just your source code; it’s much broader than that! Business plans, inventions, marketing materials, logos, copywriting, etc. – that and more is all IP. And, without proper and clear documentation assigning that IP from an employee or consultant to your company, the company’s ownership of IP is in doubt. By meticulously documenting and tracking your legal filings and documentation – you can mitigate doubts around IP so that your company can run faster toward its goals.

3. Organization and Knowledge Management Facilitates Fundraising Efforts:

Take a big breath.

Now, ask yourself: “If I was a venture capitalist, would I invest in a startup that didn’t produce clear documentation evidencing stock ownership or IP ownership?” What was your answer? Mine was an emphatic “NO!” But don’t take my word for it, ask your friends in the industry or ask your local venture capitalist. They’ll likely agree with my take: sketchy documentation is a red flag.

This question – as to what ownership in a startup looks like – is precisely why the concept of “due diligence” exists. Due diligence allows investors to assess the risk level of their investments by verifying a company’s ownership claims. The diligence process also allows investors to inspect the operations and finances of their variously situated target portfolio companies.

It is in your interest to produce organized legal documentation during the diligence process. This makes it easier (read: faster) for investors to evaluate your company’s viability and its potential risks.

You can completely defer diligence to your lawyers, but that’s a risky proposition (indeed, it’s actually economically in many lawyers’ interests to drag diligence out; if they get paid by the hour, their immediate incentive is to spend more time on diligence, not less). By taking control of your legal documentation, you can cut costs, impress your investors and move more quickly to the closing of a financing.

4. Cap Table Accuracy Depends on Underlying Documentation:

Cap tables really came into their own in the past 10 years – thanks in part due to pioneering companies like Carta, AngelList, LTSE and Pulley who help you manage your cap table in the cloud (as opposed to you manually keeping track of stock ownership in excel). Notwithstanding the bad press at Carta nowadays, they are innovators and we all owe them a great deal: they made cap tables (kind of) easy.

What does a cap table do?

A good cap table provides a detailed breakdown of equity ownership in a company, including the types and amounts of securities issued by a startup.

A good cap table also provides prospective investors (or acquirers!) with an easy-to-grasp understanding of which parties own the company (and, consequently, who has control over a company’s decision-making (i.e., voting rights), aside from the Board of Directors).

When do cap tables matter?

You’ll want to reference your cap table before a financing, to model out the economics of your round. You’ll need to provide your cap table to a 409a firm when obtaining a valuation on your common stock. You’ll want to look at your cap table when negotiating convertible notes and thinking about their conversion into stock. There will at times be questions – from you, your investors and stakeholders – about how much stock is held by certain shareholders in the company and what an exit looks like. You’ll need an accurate cap table for those use cases, too.

But cap tables don’t exist in a vacuum; they are ultimately derived from underlying legal paperwork (specifically, contracts signed between your company and its founders, service providers and investors). Thus, while maintaining an accurate cap table is crucial, without clean documentation of your legal agreements, you can’t have a clean (or reliable) cap table.

5. Speed:

Startups win, in part, because they move faster than the competition. If you take your ego out of the equation, you can’t realistically expect to move fast in business without an understanding of your legal rights and responsibilities. You should hire a lawyer to help you with that, but as you and your business grow, you should increasingly take ownership over the legal function at your startup.

Solid organization of your documents allows for quick access to legal knowledge. And quick access to legal knowledge at your company allows you to move at lightspeed.

Speed is great, but guess what’s even better? Confidence (as the Navy Seals say, “slow is smooth, and smooth is fast.”).

Implementing excellent organization at your startup will help you move fast and give you supreme confidence in everything you do as an operating company. Outsourcing this is expensive. Plus, you tell me: can you outsource confidence?

II. Is Document Management Your Responsibility or Your Lawyers’ Job?

As shown above, document management is vital for venture-backed startups.

But who is in charge of document management – founders or lawyers?

As an executive, delegation is important. If, for example, you’re focused on leading fundraising efforts for your company, you’ll probably struggle if you try to be the head of engineering or product simultaneously. But some responsibilities are too precious to fully delegate. Below, I detail several considerations for founders as they determine to what extent they delegate document management to their lawyers.

1. Cost Considerations:

Outsourcing document management to lawyers can be expensive (like $1,000 an hour expensive). What can you buy for $1,000? I looked it up. For one hour of work at that price, you could buy an iPhone 15, hundreds of thousands of Reddit advertisements or ¼ of a fully-equipped sauna sold at Costco. Save your money so you can recharge in your at-home sauna and spend the leftovers on Reddit ads to grow your empire.

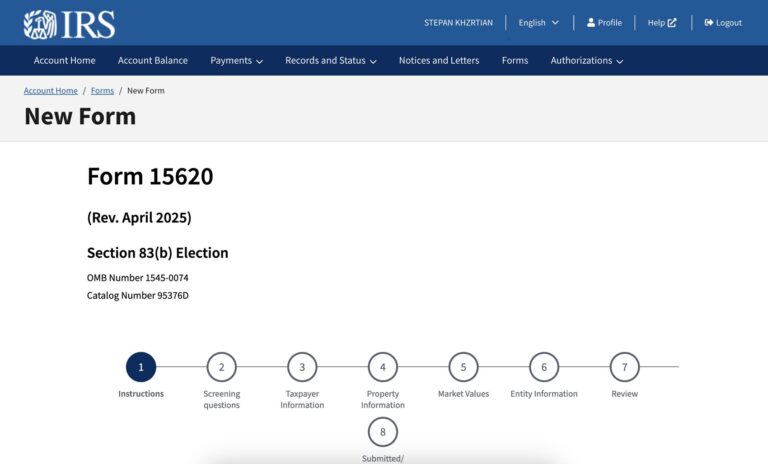

Seriously, though – cost adds up. I once had a startup client who retained my firm’s counsel after spending the first few years of its existence being served by another, larger firm. The client wasn’t in control of their documents, and the documents were poorly organized (indeed, several key documents, like 83b filings and IP assignment agreements were missing). It took our team many hours to pour over, review and analyze these documents. It costs tens of thousands of dollars just to review the issues. Then we had to fix it. Needless to say, the client was unhappy.

I wish this startup had retained a fractional general counsel* years before we got involved. (see @HeyCounsel for more info on this “fractional general counsel” concept). A fractional GC is a lawyer that functions as the general counsel for your company at lower-than-usual cost and on an on-demand basis as a contractor. This person can function as a “quarterback for legal” at your company (meaning, you snap them the metaphorical legal ball, deferring to their judgment on how serious legal issues are at your company and when to escalate those to your specialty outside counsel). If, instead of leveraging a fractional GC at your startup, you bring everything legal to your outside counsel without screening the issues, you’ll soon owe your law firm(s) the equivalent of a Costco sauna merely for their time spent considering whether your issue even needs to be addressed.

So, rethinking issue-spotting for legal issues at your company by employing a fractional GC is one way you can cut costs at your startup. Another area ripe for disruption? Document management.

As discussed above, “due diligence” takes a lot of time. Activities related to due diligence often occupy ~50% of your lawyer’s time during the financing process, and often leads to fat legal bills (and delayed closings). This is where Corpora can be really helpful, since it’s purpose-built to help startups speed up document management and diligence with the help of AI.

The crux of the issue is this: the longer it takes for your lawyers to organize, search and review your legal documentation during diligence, the higher the bill. And once the financing round starts – it’s too late. You’ll be busy rounding up investors, filling out the round and operating your business to fix all of the organizational issues you’ve accumulated over time. By implementing solid document management practices now, you’ll save yourself time, money and peace of mind later down the road.

2. Ownership, Knowledge and Control:

Who’s the boss at your startup, you or your lawyer? (I was a corporate lawyer at big firms in Silicon Valley for 3+ years, so I know the answer, don’t be shy).

If you’re the boss (and ultimately the one accountable to investors and responsible for paying your employees’ paychecks), shouldn’t you be in control of your documentation?

Deferring document management to your law firm means that you are not really aware of what’s in your “data room” at a given moment, nor do you control how things are organized, what naming conventions you use for files or anything else, for that matter. Assuming ownership means picking the platform you use to store documents, being actively involved in crafting an organizational structure and being responsible for uploading documents as they are executed over time.

Additionally, only by assuming control of document management will you fully understand the legal documents you execute on behalf of your company and their relationship to one another. As they say: “knowledge is power.” Signing contracts you don’t understand is not advised; likewise, referencing documents you don’t understand is a bad look (and potentially legally perilous!).

By taking ownership of document management, you can position yourself to actively participate in the decision-making process for your company at every step of the way.

3. How Lawyers Help With Document Management:

To give you a better understanding of how lawyers view document management and what this means for them, I’ll give you an inside look at startup lawyers’ experience handling document management on behalf of their clients*.

Corporate lawyers who serve as outside counsel to venture-backed startups likely store the contracts they prepare on your behalf in a document management system (i.e., software built specifically for law firms and lawyers to organize, store, search and manage files). The software lawyers currently use (such as @iManage, @NetDocuments and @Propel) allows lawyers to “look back” at the contracts you’ve signed in the past to understand how to approach the various legal issues that come up at your company.

For example, let’s say you’ve decided to terminate a current employee due to poor performance. As a part of their departure, you want to offer them severance in exchange for a release of claims against your company. Let’s pretend this severance package includes acceleration of certain stock awards (e.g., a stock option) held by the employee. In such a scenario, a good lawyer will want to study the underlying stock option agreement while drafting the severance agreement at issue. That’s because the severance agreement deals, in part, with the same subject-matter that is covered in the stock option agreement. The two documents are interrelated, and the text of the new contract (i.e., the severance agreement) will reference the prior contract (i.e., the stock option agreement).

To make all this work, your lawyer needs quick access to your documents. Put differently, the longer it takes them to find and review your stock option agreement, the longer it takes to separate from this employee cleanly and cordially. Thus, while founders should assume responsibility for document management, collaboration with lawyers is unavoidable.

Lawyers read contracts better and faster than you can (truly, that’s their job!). Document management is best understood, then, as a collaborative process between founders and their lawyers. That being said, and as shown above, if you don’t control the process and assume ownership of the documents, it’s easy for lawyers to run up your bill during a financing or otherwise.

Conclusion:

In conclusion, legal paperwork is (one of) the foundation(s) of your startup.

Legal documents are the “source of truth” for your company and, therefore, keeping good track of these documents will enable you to move at breakneck speed with extreme confidence.

Founders should take ownership over document management, leveraging their lawyers when necessary, to effectively manage their companies and to keep costs down.