📣 Finally, the day has come!

The IRS now accepts 83(b) elections electronically. ⚡

Taxpayers may continue mailing in their form if they’d like.

(𝘉𝘶𝘵 𝘸𝘩𝘺 𝘸𝘰𝘶𝘭𝘥 𝘺𝘰𝘶?! 𝘙𝘦𝘢𝘥 𝘰𝘯 𝘵𝘰 𝘧𝘪𝘯𝘥 𝘰𝘶𝘵).

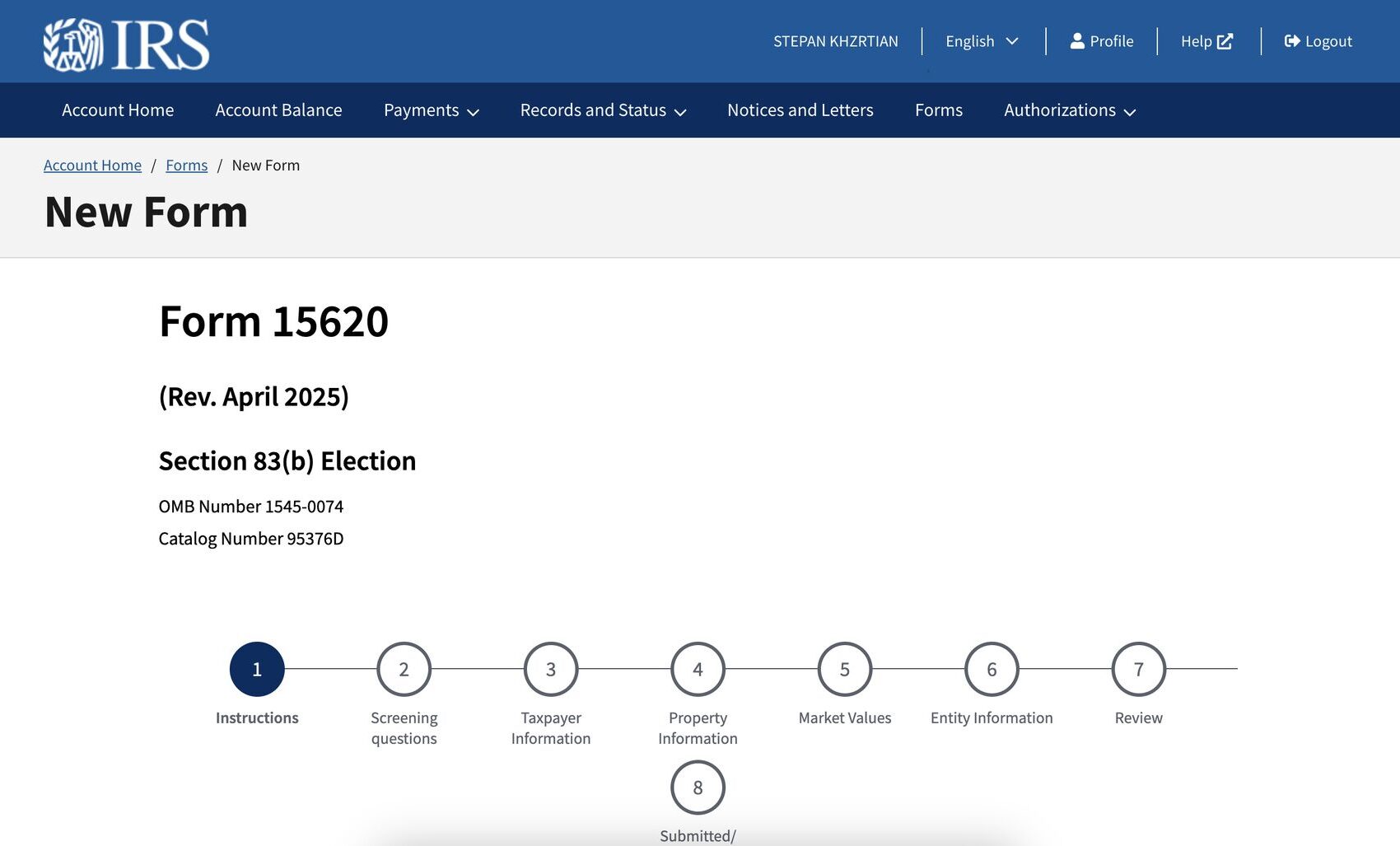

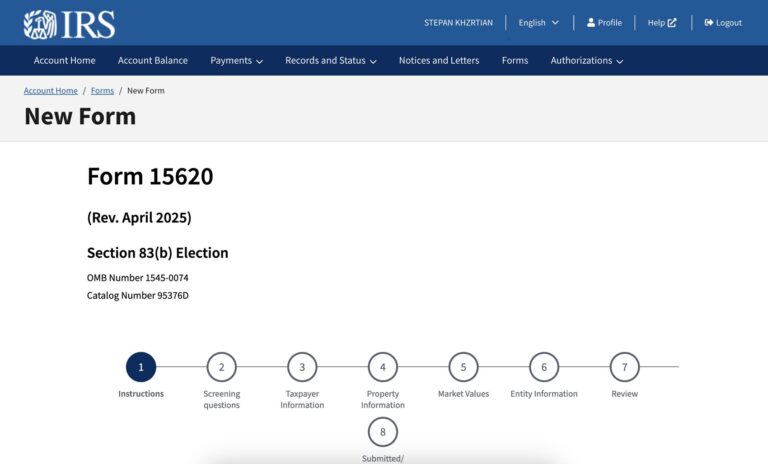

A few months ago, the IRS released an official form for making a Section 83(b) Election – 𝗙𝗼𝗿𝗺 𝟭𝟱𝟲𝟮𝟬. Today, taxpayers can log into the IRS portal and use that form to make an 83(b) election.

At Corpora, we checked out the IRS tool to see how it works! Here are the pros and cons:

Pros

✅ 𝗜𝗻𝘀𝘁𝗮𝗻𝘁 𝗳𝗶𝗹𝗶𝗻𝗴: You no longer have to wait for your paper 83(b) election to be delivered to the IRS. Once you submit electronically, it’s filed.

✅ 𝗘𝗹𝗲𝗰𝘁𝗿𝗼𝗻𝗶𝗰 𝗿𝗲𝗰𝗼𝗿𝗱𝗸𝗲𝗲𝗽𝗶𝗻𝗴: The IRS should provide you with an electronic proof of filing once you submit.

✅ 𝗙𝗿𝗲𝗲 𝘁𝗼 𝘂𝘀𝗲: No payment is necessary to electronically file your 83(b) election.

Cons

❌ 𝗣𝗿𝗶𝗰𝗲 𝗽𝗲𝗿 𝘀𝗵𝗮𝗿𝗲 𝗹𝗶𝗺𝗶𝘁𝗮𝘁𝗶𝗼𝗻𝘀: Taxpayers cannot input a price per share that has more than two decimal places. In other words, the typical startup FMV of $0.00001 or $0.0001 is not supported.

❌ 𝗡𝗼 𝗳𝗼𝗿𝗲𝗶𝗴𝗻 𝗶𝗻𝗱𝗶𝘃𝗶𝗱𝘂𝗮𝗹𝘀: Taxpayers without a U.S. TIN (such as a SSN or ITIN) cannot use the tool. There’s no possibility to write “N/A” or “Applied for” as your TIN.

❌ 𝗢𝗻𝗹𝘆 𝗳𝗼𝗿 𝗶𝗻𝗱𝗶𝘃𝗶𝗱𝘂𝗮𝗹𝘀: The tool is intended only for use by individuals (natural persons). Entities cannot use the tool to make an 83(b) election.

We’re excited that the e-file option is finally here, and we’re also certain that the Internal Revenue Service will continually improve its product experience.

In the meantime, Corpora is continuing with business as usual, as we were anticipating this development from Day 1. Happy to say that our product continues to solve an acute problem, both for startups and for enterprise companies with volume filing needs.

Finally, a big thank you to Bruce Brumberg of myStockOptions.com for breaking this news!