Key takeaway

While the 83(b) election form seems straightforward, some items require additional clarification. This blog post provides actionable tips so that you get your form right.

Intro

You start filling in your 83(b) election form. It seems like a breeze! You fill in your name, your address, your social security number, and then…

What’s a taxable year?

Date of transfer?!

Transfer restrictions??

Ok, maybe this wasn’t as straightforward as you thought.

You neither have the bandwidth nor the will to peruse regulations to figure out how to respond to these questions.

That’s where this blog post comes in.

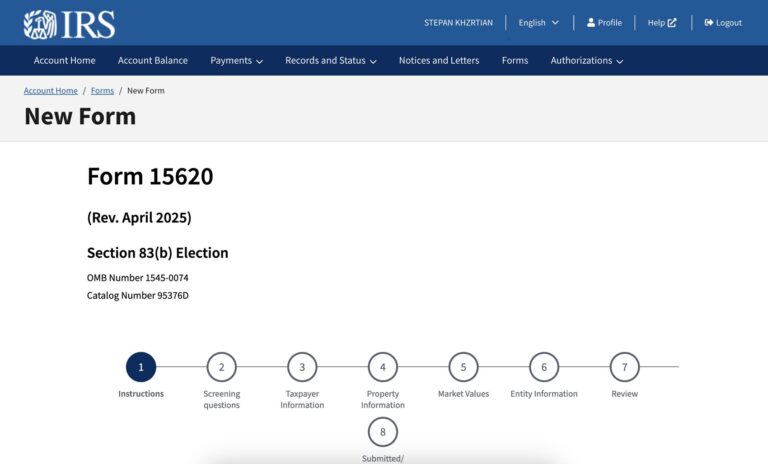

The 83(b) Election Form

Let’s introduce our hero here: the 83(b) election form. In this section, you’ll find what a common 83(b) election form looks like, what the IRS sample looks like, what the required fields are, and what the form looks like when it’s filled in.

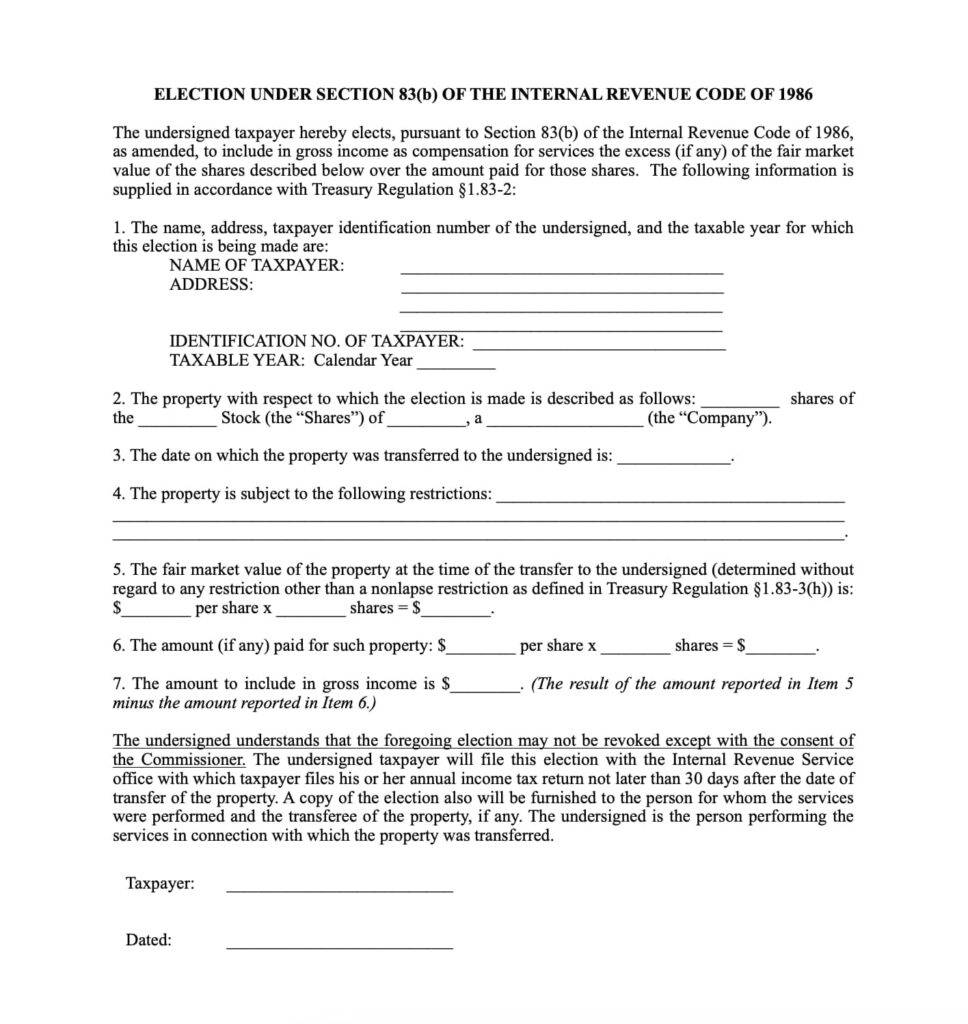

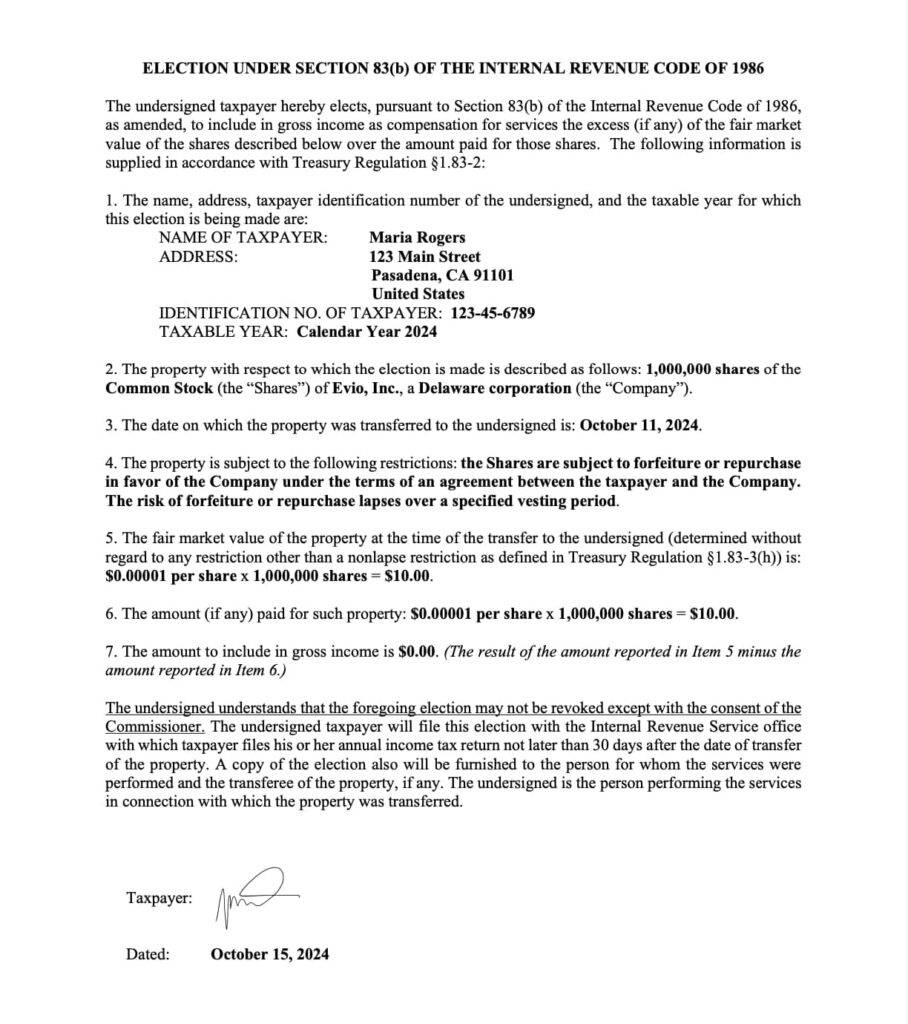

83(b) Election Template

Here’s what a common 83(b) election form looks like:

This is just one example of what a template 83(b) election form looks like. It has all the fields that are required by the Internal Revenue Service.

Seven items on the form, and we’ll dive into each of them in turn.

But before that, let’s look at the official 83(b) election sample form shared by the IRS.

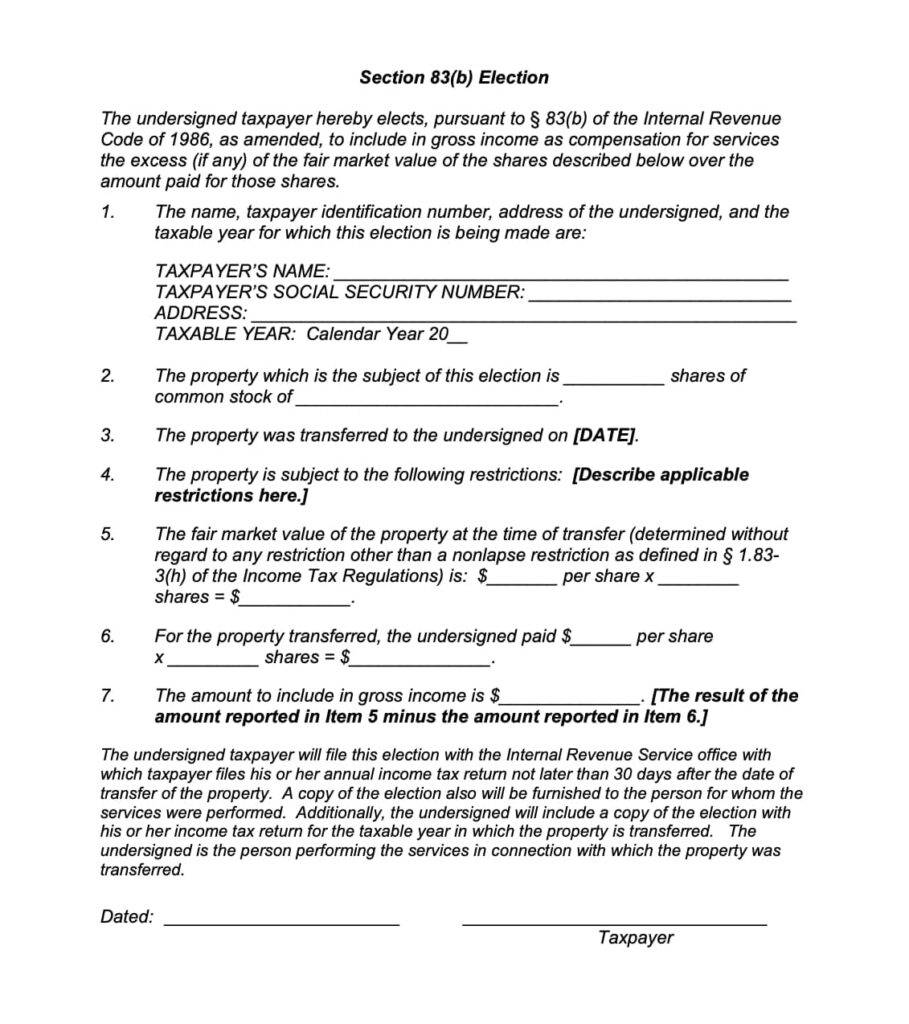

Official IRS sample form

In 2012, the IRS issued Revenue Procedure 2012-29 covering the 83(b) election, complete with a background on the Section 83(b) election, consequences of making the election, example scenarios, and even a sample election:

You’ll see the same seven items on this sample form, with slightly modified wording. Again, what’s important in making the Section 83(b) election – regardless of which form is used – is ensuring that the required information is provided to the IRS.

What are those fields, you ask?

Let’s cover those next.

Mandatory fields for 83(b) Election

In 26 CFR § 1.83-2(e), the Federal Regulations provide what the content of a properly made 83(b) election statement should include:

- The name, address and taxpayer identification number of the taxpayer;

- A description of each property with respect to which the election is being made;

- The date or dates on which the property is transferred and the taxable year (for example, “calendar year 1970” or “fiscal year ending May 31, 1970”) for which such election was made;

- The nature of the restriction or restrictions to which the property is subject;

- The fair market value at the time of transfer (determined without regard to any lapse restriction, as defined in § 1.83-3(i)) of each property with respect to which the election is being made;

- The amount (if any) paid for such property; and

- With respect to elections made after July 21, 1978, a statement to the effect that copies have been furnished to other persons as provided in paragraph (d) of this section1.

It’s worth stressing that this same section also requires the person making the election to sign it as well as indicate that they are making the election under Section 83(b) of the Internal Revenue Code.

Maria’s 83(b) Election

Let’s take our original template and fill it in, to make all this more tangible. We’ll then use the provided information to go over each of the items of the form in turn.

Deep-Dive on Each Item of the 83(b) Election Form

With the basics of the form squared away, let’s go ahead and deep-dive into each of the items, in turn.

Name, address and taxpayer identification

Your name

Probably the simplest item on the form. Insert your full legal name (for example, as provided in your ID). If your spouse is joining in the election (which may be appropriate in community property states, for example), provide their full legal name as well.

Your address

Normally, this is your residence address. If you file U.S. tax returns, provide the same address you put in your form.

Your taxpayer identification number

This is your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

Here are a few other scenarios:

- If you don’t have an SSN or ITIN, consider if you’re eligible to apply for an ITIN. If you are, and you’re willing to apply for one, write “Applied for” here – and apply for the ITIN.

- If you don’t have an SSN or ITIN and you’re ineligible to apply for one (or don’t want to just yet), write “Foreign individual” or “N/A” here.

- In any case, if you’re in a situation where you don’t have an SSN or ITIN, make sure you consult with a qualified legal or tax professional.

This blog post provides a comprehensive guide for non-U.S. taxpayers considering making the 83(b) election.

Calendar year

Since the 83(b) election is a tax document and affects your taxes, you should specify the taxable year for which you’re making the election. Normally, this would be the calendar year in which you received your grant. So, for example, if you received your grant on October 11, 2024, the taxable year would likely be Calendar Year 2024.

Description of property

Describe the property for which you’re making the election. Normally, this refers to the equity you’ve been granted and for which you’re making the 83(b) election. The description usually has the following components:

Amount of equity

This is the number of shares – or profits interests, or other equity – that you’re receiving. In the example above, Maria received 1,000,000 shares.

Type of equity

This is the type of equity you’re receiving. While shares of common stock are common (no pun intended), the recipient may instead be getting, say, shares of Class A Common Stock or shares of Non-Voting Common Stock, etc. Rather than shares, it may be another type of equity altogether: such as profits interests or LLC units. In this example, Maria received shares of Common Stock.

Company granting the equity

Which entity is this equity for? Describe that entity, providing the full legal name, the state it was formed in, and the type of entity. In this example, the equity is in Evio, Inc., which is a Delaware corporation.

Date of Transfer

Many equity recipients have trouble with this item. “Date of transfer? What’s that?”

In IRS-speak, this is the date on which the property (for our purposes, the equity) is transferred to the person performing services.

In more common parlance, this is your grant date – the date on which your company formally approved the issuance of your stock to you. If you’re fortunate enough to have a well-maintained cap table (which really mustn’t be viewed as a luxury, but, rather, as a necessity for any company), your grant date should be recorded on it. If not, then you have some homework to do.

For a detailed guide on how to pin down your date of transfer, check out this segment of a prior blog post.

In our example above, Maria’s date of transfer – the grant date for her 1,000,000 shares of Common Stock in Evio – is October 11, 2024.

Transfer Restrictions

Here’s another one that confuses many equity recipients.

If you search for “restrictions” in your equity grant document – such as your Restricted Stock Purchase Agreement – chances are you’re going to end up in the “Legend” section (which says that your stock cannot be freely transferred) or “Lock-up Period” section (which says something to the tune of not being able to sell your stock during a 180-day period after the company goes public.

When it comes to describing your transfer restriction in your 83(b) election, neither of these are relevant. Instead, for our purposes, we’re looking for transfer restrictions that subject your equity grant to forfeiture or repurchase, for instance, when your employment or services relationship with your employer is terminated.

If “vesting schedule” comes to mind, you’re on the right track.

Normally, we see at least one of two things going on in equity agreements with a vesting schedule:

- The company maintains a “repurchase option” – meaning, it can repurchase some or all of the unvested equity in case the employment or services relationship is terminated, or

- The unvested equity is automatically forfeited back to the company in case the employment or services relationship is terminated.

So, when inserting your transfer restrictions in your 83(b) election, you want to make sure to capture the essence of such repurchase or forfeiture possibility. The language provided in Maria’s 83(b) is generic enough to cover a multitude of scenarios (it refers to both forfeiture and repurchase), while also being specific enough to pass as transfer restrictions (referring to the vesting schedule). If you’re at a loss of what to write for the transfer restriction, this template language is a good starting point.

FMV at Transfer

Next up is providing the fair market value (FMV) of your equity at the time of grant. This shouldn’t be too complicated, since your equity grant agreement (such as your Restricted Stock Purchase Agreement) should explicitly mention this value.

Also, while it’s not required to provide the math in the election form, doing so helps you double-check the accuracy of your inputs.

In Maria’s case, the FMV of her equity grant is $0.00001 per share for her grant of 1,000,000 shares, equaling $10.00 total.

Amount Paid

The recipient of equity may or may not have paid money for the shares. This is the part where this information is reflected. Payment here is referring to “any money or property paid for the transfer of property” – normally, however, it refers to cash consideration, such as writing a check, making a wire transfer, or otherwise providing readily available funds. It can also be paid by means of canceling indebtedness. For the avoidance of doubt, services performed don’t count as consideration for purposes of this item.

It’s worth noting that it’s possible that nothing was paid for the shares – they were granted simply in consideration for past and/or future services. In that case, the value here should be $0.00.

In Maria’s case, she has in fact paid cash consideration, totalling $10.00

Gross Income

Let’s not forget that the 83(b) election is a tax document, and taxes go hand-in-hand with the income which forms the basis of that tax. How to arrive at that income? By deducting any amounts paid for the property by the fair market value of the property received.

If the two figures are equal – you paid an amount equal to the FMV of the property you received – then you don’t have income from the transfer of this property. Thus, the difference is $0.00, as in Maria’s case.

However, if you didn’t pay anything for the equity received – or paid less than its FMV – then that positive balance is your gross income, which will be included in the gross income of your taxable year.

It’s also worth noting that the IRS does not require you to do the math and specify your gross income. That said, again, it’s good practice to still do so for additional accuracy and, generally, good document hygiene.

Other Important Requirements

We covered the primary contents of the 83(b) election in the form of the fields that the taxpayer fills in. However, there are a few other items which you should check off to make sure your 83(b) election passes the bar.

Specifying that this is a Section 83(b) Election

The IRS makes it clear that, in order to properly make a Section 83(b) election, the taxpayer should indicate so: that the election is being made under Section 83(b) of the Internal Revenue Code.

Specifying that copies have been properly distributed

This is another clear requirement. Along with sending the 83(b) election to the IRS, the taxpayer should also furnish a copy of the election to the person for whom they’re providing services (that is, the employer) and – if it’s a different person than the taxpayer – the person who actually received the transferred property.

Sign it (and date it)

Your 83(b) election must be signed. In fact, pre-COVID, the IRS would only accept “wet” signatures (that is, signatures made in ink right on the paper). Given the pandemic, the IRS allowed the usage of electronic signatures for a number of filings, including the 83(b) election, which allowance was permanently extended on October 30, 2024.

Wondering what counts as an “electronic signature”? Pretty much any kind of mark – you can type in your name, insert a scanned image of your signature, use an e-signature platform, and more. You can find the list of acceptable forms of electronic signatures here.

Conclusion

It’s just one page, the 83(b) Election, but it has more than its fair share of opaque phrases and statements for the layperson taxpayer. Given how much is at stake here, you don’t want to rush this… yet with the right amount of awareness, information, and guidance, you can prepare your document and send it off to the IRS with confidence and peace of mind.

Footnotes

- This last point essentially means that the person making the election (the taxpayer) should provide a copy of the election to the person for whom they are performing services (that is, their employer). Additionally, if the person who receives the property and the person performing the services are not the same person, then the person performing the services should also provide a copy of the election to the recipient of the property ↩︎