Key Takeaway

You have 30 days from the day you get your equity to file an 83(b) election with the IRS. You meet the deadline when you properly mail it on time – regardless of when it’s delivered.

Intro

You’ve heard the magic number so many times:

30 days.

If you’re getting stock that is subject to vesting, you have 30 days to make an 83(b) election.

But… 30 days from what?

And what if the deadline falls on the weekend or a holiday?

And what exactly do I have to do to meet the deadline? Must the IRS receive it by the deadline for me to be clear?

That’s where this post comes in. These are all fair questions, and we’ll cover them each in turn.

Let’s go.

When does the 30-day period start?

The 30-day period starts to tick from the day you get your equity – also known as the “date of transfer”.

Not very helpful, we know. So, how do you figure out the day on which you got your equity?

Date of transfer = Grant date

Basically, your “date of transfer” is the same thing as your “equity grant date” – the date on which your equity was formally granted to you. Here are some other terms which are generally used interchangeably with “equity grant date”, in they may be more familiar to you:

- Grant date

- Date of grant

- Issuance date

- Issue date

- Date of issuance

- Date of issue

And that, in turn, leads us to another question:

How do I find out my grant date?

Granting equity is no casual task – there’s a procedure involved to get it right, especially in a corporation: the board has to approve the issuance, you have to sign a stock purchase agreement, potentially pay for the stock you’re getting, maybe get a stock certificate, and update your cap table to reflect the issuance.

That’s a lot. But let me distill it for you by pinpointing where exactly you’d want to look to find out your grant date.

Your cap table

This is where I would start. If your cap table is properly maintained – for example, by a law firm, equity consultant, or a team member who knows what they’re doing – then someone would have already done their homework. Your equity issuance should be a line item on the cap table, complete a note on your grant date (or another one of the terms listed above).

That’s the date you want to use.

Your stock certificate

You might have received a stock certificate for your shares (or another securities certificate for other kinds of equity) – whether in physical or electronic form. Normally, the certificate will make clear when the equity was issued to you. That’s the date you’re looking for.

Your stock purchase agreement

If you’re a founder, employee, or advisor at a startup and you’re getting stock (as opposed to stock options), this document will normally be called a “Restricted Stock Purchase Agreement” or, less commonly, a “Common Stock Purchase Agreement”. It’ll have a different title if you’re getting, say, profits interests or profit units in an LLC.

Normally, the date at the top of this grant document is what you’re looking for. It would say something like this agreement “is made as of”, “is effective as of”, or “enters into effect on” a certain date. Chances are that that’s the date you need.

But some agreements can be tricky. Instead of giving you a date, they might make you work for it by saying that the agreement enters into effect on the date of last signature. That means we need to find the date when the last person to sign the agreement in fact signed it. Scroll to the signature page, and pick the latter of the two dates.

Your board consent

I’m referring to the official company resolution which officially grants the equity. In a corporation, it’s normally a board consent or meeting minutes. In an LLC, it may be a resolution adopted by, say, a compensation committee.

The board consent will clarify when it enters into effect. Is it the date “first mentioned above” or “last mentioned below”? If so, scroll there and pick that date. Is it, instead, the “date of last signature” like with some stock purchase agreements? Then scroll to the signature page and pick the last date.

But again, some board consents can be tricky (trickier than some stock purchase agreements). They may have funky language that says the equity is considered issued when certain conditions are met – such as the stock purchase agreement being signed and the stock paid for. This may send you on a quest through paperwork and bank records to find the right answer!

What if the dates conflict?

Well, that’s inconvenient – and may signal a bigger problem. That’s your sign to have your documents reviewed by a competent attorney as soon as you can.

But before we get all doomsday here, a simple rule of thumb is to work your way up the list provided above. Board consent > stock agreement > cap table/stock certificate.

- Start with the board consent (or other company resolution authorizing the equity issuance). This is the source of authority and should be taking precedence.

- Then move on to your stock purchase agreement. If there’s a conflict with the board consent, opt for the consent’s date.

- Finally, check out your cap table and/or stock certificate (the dates of which, I pray, will match). Again, if it conflicts with the board consent, opt for the consent’s date.

What if I got my date of transfer wrong?

It depends on how royally you’ve messed up your date of transfer. If you’re off by a day and you’ve otherwise comfortably met the 30-day deadline and properly mailed your filing, it’s unlikely that you’ll have an issue.

If, instead, you’re off by a couple weeks (especially if you listed a date after your true date of transfer rather than before), then you might want to talk with a legal or tax professional on this.

In either instance, if you’re still within the 30-day period, go ahead and submit a corrected filing, making sure to conspicuously note on your filing that it’s a corrected version (also identifying what exactly is being corrected).

Ok, and when does it end?

Perfect. We now know when the 30-day period starts. Now, let’s figure out when it ends. There are a few things to take into account here.

30 calendar days

30 days is 30 calendar days, not business days. So, yeah, that basically means much less time for you to file. #nopressure

Don’t count the grant date

The day you got your equity does not count as one of the thirty days. In other words, the grant date isn’t “Day 1”; it’s “Day 0”. The day after your grant date is Day 1.

30th day is a weekend or holiday?

If the last day of the 30-day period falls on a Saturday, Sunday, or a legal holiday, then you get the gift of an additional day… or more! Kind of like pulling a Community Chest card in Monopoly and collecting $10 because you won second prize in a beauty contest (well, sort of?).

Legal holiday… where?

We’re looking at legal holidays in the District of Columbia (essentially, federal holidays), but also within the state where your filing is headed – Missouri, Texas, or Utah. However, to err on the side of caution, you may want to look at federal holidays only when determining your deadline.

A few examples

If your grant date is Monday, August 19, 2024, your last day to file is Wednesday, September 18, 2024.

If your grant date is Monday, September 19, 2024, your last day to file is Monday, October 21, 2024. That’s because the last day of the 30-day period falls on Saturday, October 19, 2024, which automatically pushes your deadline out by two days to the next business day.

If your grant date is Thursday, October 10, 2024, your last day to file is Tuesday, November 12, 2024. That’s because the last day of the 30-day period falls on Saturday, November 9, 2024, and Monday, November 11, 2024 is a legal holiday (Veterans’ Day). That’s three extra days to file!

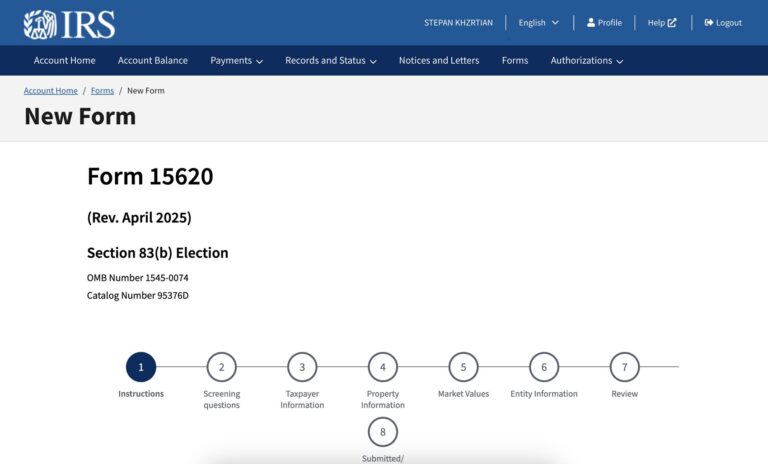

Here, you also get an entire article that breaks down an example 83(b) form so that you don’t miss any detail.

Credit: Bob, Beverly, and Bernice on eBay

How do I meet the deadline?

Great question. There’s often confusion about what has to happen so that the filing is considered on time. Do I have to mail it in before the 30-day deadline? Does my mail have to be delivered to the IRS before the 30-day deadline? Or, further, does the IRS have to acknowledge receipt of my filing before the 30-day deadline?

The answer here is clear: if you mail in your 83(b) election on time, then you’re deemed to have met the deadline. However, not all mail services are considered equal. Let’s talk about it.

Timely mailing treated as timely filing

A very convenient rule of the U.S. Code provides that if you mail a document to a governmental agency on time, it’s considered filed on time. That’s why it’s called, you guessed it “timely mailing treated as timely filing”.

In the case of an 83(b) election, what this means is that if you mail your 83(b) election to the IRS within the 30-day period, it’s considered to be filed with the IRS on time.

However, there is a very important catch here which is often overlooked.

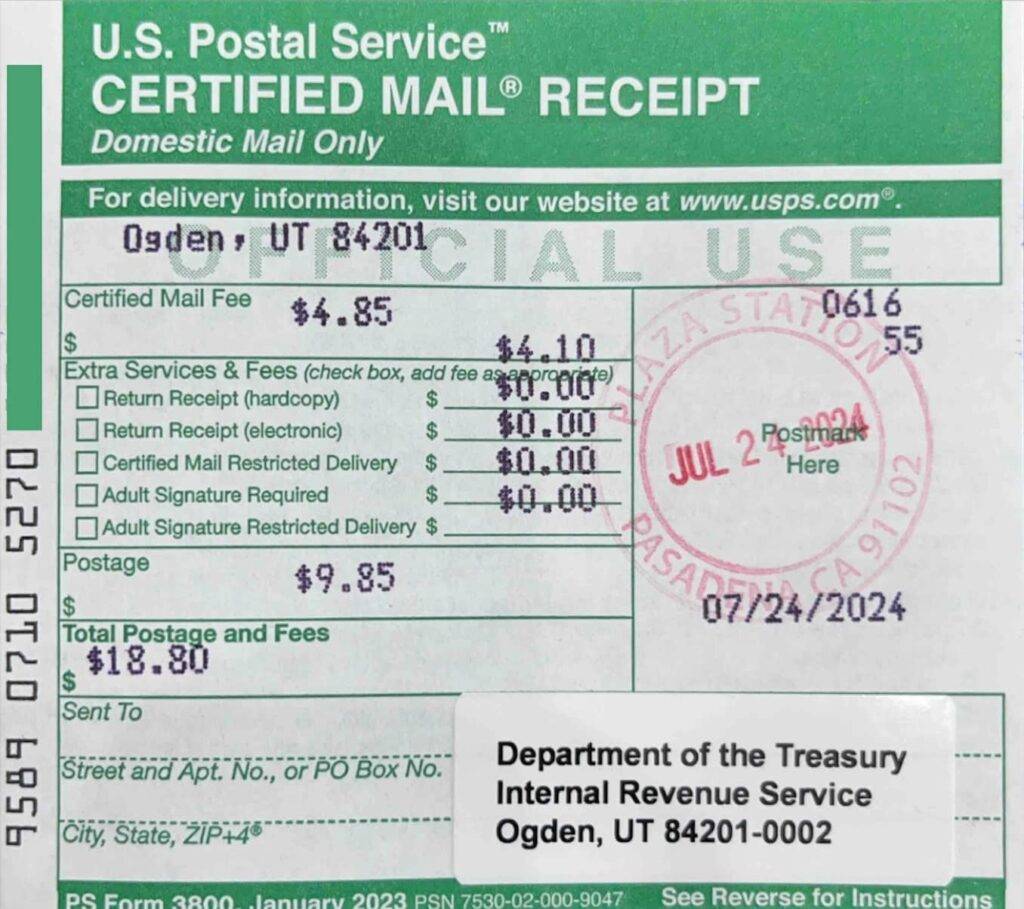

In order for this rule to kick in, generally, your mail has to have a postmark – an imprint on your envelope that clearly shows when the U.S. Postal Service (USPS) obtained possession of your mail.

No postmark = no U.S. Code convenient rule.

How do I get a postmark?

The only way to guarantee that your mail has a postmark is to actually visit a post office, hand the clerk your mail, and ask them to postmark your mail in your presence. Once that stamp hits your mail (or the official postage receipt is affixed to your mail), you’re good. You’re covered under the convenient “timely mailing as timely filing” rule.

You may be tempted instead to just drop your mail in a mailbox and rely on the postman to postmark it when they collect your mail. The rude reality is that such mail is rarely postmarked – it’s just dumped into a postal bag or box and put right into the mailstream.

With the lack of a postmark, you will have a very hard time proving when exactly you mailed your 83(b) election.

What’s the deal with USPS Certified Mail?

Well, I’m glad you asked. Certified Mail is a service of the USPS that offers additional protection and benefits. It’s also specifically called out in the “timely mailing as timely filing” rule.

Here’s the deal: under the mentioned rule, the fact that an 83(b) election is sent using Certified Mail is considered to be “prima facie evidence” that the filing is delivered to the IRS.

In plain-language terms, your filing is presumed to be delivered to the IRS, even if it’s not actually delivered to the IRS. Just to be clear, this presumption is rebuttable (technically, the IRS can bring evidence to try and prove the filing was not, in fact, delivered).

Other than serving as “prima facie evidence” of delivery, Certified Mail also serves as “legal proof of mailing” – but only if you get your USPS Certified Mail receipt (Form 3800) postmarked by the clerk.

Again, remember, these benefits are afforded under the “timely mailing as timely filing” rule if you get a postmark on your mail. Without a postmark, generally, the rule does not apply.

First Class Mail vs. Certified Mail

Put simply:

- If you send your mail via First Class mail and just get a postmark, you’re still covered by the “timely mailing as timely filing”;

- If you send your mail via Certified Mail and get a postmark, you get legal proof of mailing and prima facie evidence of delivery in addition to being covered by the “timely mailing as timely filing” rule.

What about Registered Mail?

Registered Mail has all the benefits and protections of Certified Mail mentioned above. In addition, it’s also the most secure way of sending mail via USPS (and, hence, it’s substantially more expensive). Generally, when it comes to mailing 83(b) elections with USPS, Certified Mail is the more popular option.

What if I don’t get a postmark?

If you don’t get a postmark, you can’t avail yourself of the “timely mailing treated as timely filing” rule. In practical terms, what that means is:

- Your 83(b) election has to be delivered to the IRS by the 30-day deadline,

- The IRS has to actually receive your 83(b) election, and

- Preferably, you should have some kind of proof that the IRS actually received your 83(b) election (such as a date-stamped copy of your filing returned to you).

You can see that the points of failure are substantially higher if you don’t make the extra effort of getting that postmark on your envelope. So, get that postmark on your envelope.

Conclusion

You have 30 calendar days from the day you get your equity to file an 83(b) election. The day you get your equity – aka, your grant date – is considered “Day 0” in that 30-day period. If Day 30 falls on a Saturday, Sunday, or a legal holiday, then your deadline is the next business day. You will have met the deadline if you mail your filing on time, regardless of when it’s actually delivered – so long as you get a postmark on your envelope.