Key takeaway

The 83(b) election is available to you even as a non-U.S. taxpayer. If there’s any possibility that you may become a U.S. taxpayer during your vesting schedule (usually, four years), then filing the 83(b) election while you do have the chance can help you save handsomely on taxes later on. This post provides detailed guidance on how to properly make your filing.

Intro

You’re just about to start your startup, which you’re incorporating in the U.S. (you hear people recommending a Delaware C-corp).

You’ve heard about making sure your and your co-founder’s stock is subject to vesting, such as the usual four-year vesting with a one-year cliff.

And you’ve also heard – repeated ad nauseam – that whenever you’re getting stock subject to vesting, you should file an 83(b) election, and that not filing the 83(b) election will have drastic consequences for you down the line, even costing you your financing round.

So, you figure that you absolutely have to file the 83(b) election.

But… there’s one small problem:

You’re not a U.S. taxpayer.

In fact, you’ve never even visited the United States.

You don’t have a Social Security Number.

And you’re not even sure if the 83(b) election even applies to you.

So, you’re wondering…

Even if I should file the 83(b) election… can I file it? And if so, how?

Well, this is what this article is all about.

But first, what is the 83(b) election anyway?

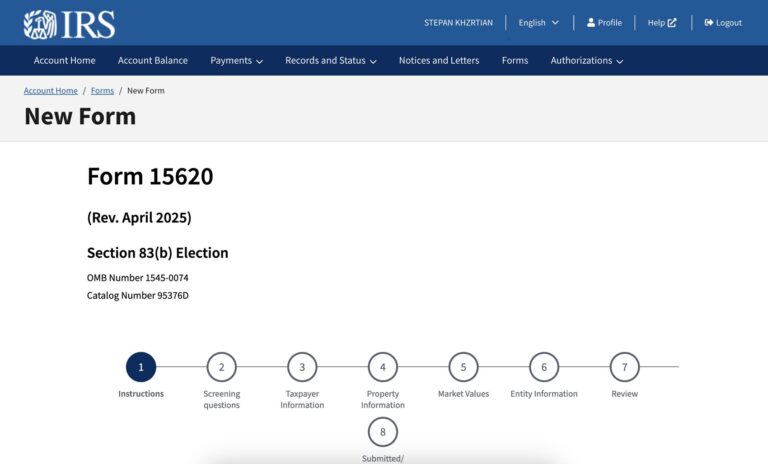

The 83(b) election is a tax form you send to the Internal Revenue Service (IRS) – the federal tax authority of the United States – informing them about your decision to pay taxes on your stock on their fair market value, or FMV (minus what you paid for them, if anything) at grant, rather than at vest.

You have only 30 days from the date of getting your stock to make this election.

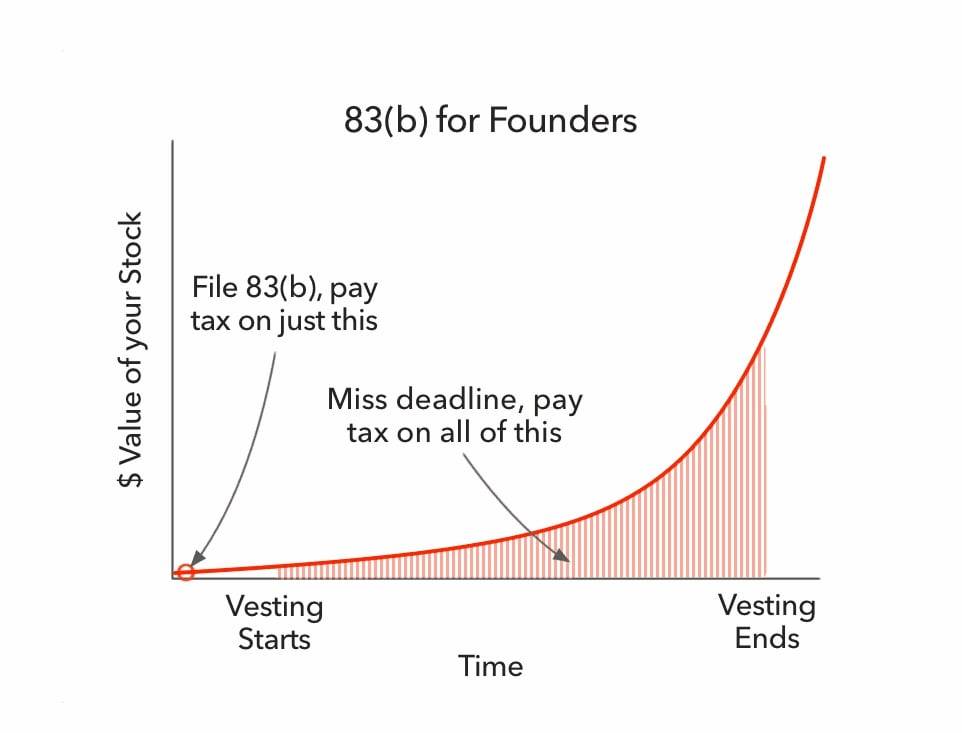

Let’s add some numbers to make this easier to follow, and here’s a graph to follow along.

Credit: PNW Startup Law

Typical scenario of a founder getting stock

- You’ve incorporated your company, authorizing a standard 10,000,000 shares.

- You and your co-founder are each granted 4,000,000 shares on December 31, 2023.

- The shares are subject to a four-year vesting schedule with a one-year cliff starting on December 31, 2023.

- The par value of each share of stock is $0.00001.

What’s the FMV of my stock at grant?

When you’re granted your stock on December 31, 2023, the fair market value of your stock is:

4,000,000 shares x $0.00001 par value per share = $40.

What’s the FMV of my stock at vest?

This is where it gets a bit tricky, for a couple reasons:

- There isn’t one date when vesting happens. Instead, with your typical four-year vesting schedule with a one-year cliff, you have 37 instances of vesting: once at the one-year cliff, and another 36 times over the course of the 36 months following the cliff.

- You just don’t know in advance how much the FMV of your stock is going to be in the future – one year, two years… four years from now.

On that second point, let’s consider two variations: you do not raise a venture round during the four-year vesting period of 2023-2027, and you do.

You don’t raise a venture round.

Let’s assume you don’t raise a venture round over these four years, you’re not acquired, and you don’t have any explosive growth that will substantially increase the value of your stock. Instead, let’s assume the value of your stock doubles year-on-year, starting with the par value for 2024.

- 1/4th of your stock, or 1,000,000 shares, vests in 2024 (on December 31, 2024), at a par value of $0.00001. The FMV of your shares vesting in 2024 is $10.

- Another 1,000,000 shares will vest in 2025 (vesting about 83,333 shares per month over 12 months). Let’s assume they vest at a value of $0.00002 per share (or double the par value). The FMV of your shares vesting in 2025 is $20.

- Another 1,000,000 shares will vest in 2026. Let’s assume the value has again doubled. The FMV of your shares vesting in 2026 is $40.

- Finally, another 1,000,000 shares vest in 2027. The value has again doubled. The FMV of your shares vesting in 2027 is $80.

So, over four years, the FMV of your shares at vest has been $10 + $20 + $40 + $80 = $150.

You do raise a venture round.

This is one of those golden scenarios. You put in hard work, and in January 2026 you get a nice term sheet valuing your company at a pre-money valuation of $10,000,000.

The moment you get that term sheet, your company gets a price tag: $10,000,000. Assuming you have a fully diluted capitalization of 10,000,000 shares at that time, the FMV of each share comes to $1.00.

This changes our math quite a bit:

- The FMV of your 1,000,000 shares vesting in 2024 is still $10.

- Let’s assume that for 2025, it’s still $20.

- But come 2026, the FMV of your 1,000,000 shares vesting that year is… $1,000,000!

- And for 2027, guess what, it’s likely at least $1,000,000 if not more.

So, with you raising a venture round in 2026, the FMV of your stock at vest over the course of four years is more than $2,000,000!

Let’s do the taxes

Alright, now that we’ve laid the groundwork, let’s take the math a step further and figure out your tax liability for three scenarios:

- You’ve filed an 83(b) election

- You haven’t filed an 83(b) election and you don’t raise a venture round

- You haven’t filed an 83(b) election and you do raise a venture round

For purposes of calculating the tax due, I’ve applied a 35% ordinary income tax rate.

| 83(b) filed | No 83(b) filed, no venture round | No 83(b) filed, venture round | |

| Relevant FMV | $40 | $150 (at vest) | $2,000,000 |

| Tax due | $14 | $52.50 | $700,000 |

Factoring in price paid per share

An important caveat here – the tax calculations above assume that you didn’t pay anything for your stock when getting it (which, by the way, you should, as explained here). If you did, in fact, pay cash for your stock equal to the par value, then you’ll be paying tax on the FMV of your shares (at grant or at vest, as relevant) minus what you paid for them.

So, if you paid $40 for the $40 worth of stock you got on December 31, 2024, and you file your 83(b) election, you tax liability on your stock acquisition will be… $0.

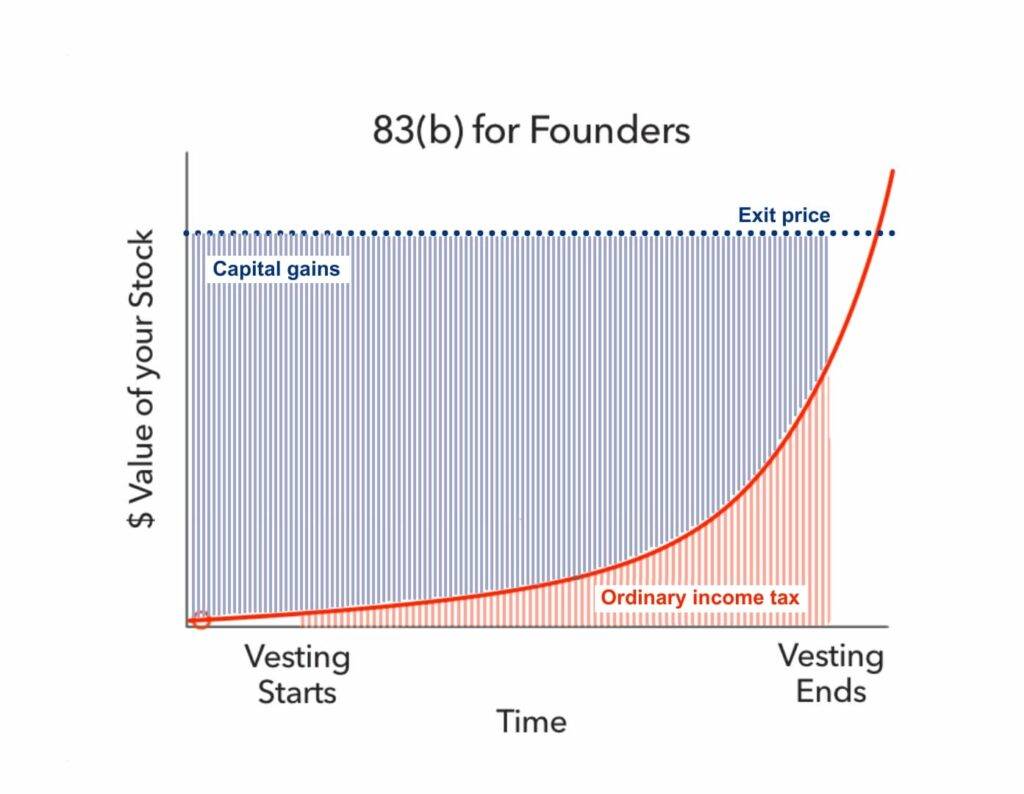

What happens when I sell my shares?

Great question. The taxes we’ve been talking about until this point are for your acquisition of the shares. The relevant tax? Ordinary income tax.

When you sell your shares, you’ll be taxed again. The relevant tax? Capital gains.

If you filed your 83(b) election, the relevant capital gains will be equal to the exit price minus the FMV at grant (or $40). If you did not file your 83(b) election, the relevant capital gains will be equal to the exit price minus the FMV at vest (or $2,000,000, in the scenario where you raise a venture round).

However, all else being equal, you’re still better off filing the 83(b) election because capital gains tax rates are usually substantially lower than (and sometimes half of) ordinary income tax rates.

Here’s a helpful graph to visualize this.

Credit: PNW Startup Law; Corpora

As a Non-U.S. taxpayer, how is the 83(b) election relevant to me?

The short answer is… it’s not.

The 83(b) election is relevant only for U.S. tax purposes. If you’re not subject to U.S. taxes, then filing or not filing an 83(b) election will not have an impact on your tax situation. In fact, filing an 83(b) election should not have an impact on your foreign (non-U.S.) tax situation.

But – and this is an important “but” – what if you do become a U.S. taxpayer in the future, namely, during your vesting schedule?

That completely changes the story.

And if you didn’t file your 83(b) election when you had the opportunity to do so (during the 30-day window), then you’re going to bear the consequences later on if and when you do become a U.S. taxpayer.

How would I become a U.S. taxpayer?

Here are a couple scenarios which might see you becoming a U.S. taxpayer:

- Becoming a U.S. citizen

- Becoming a U.S. resident, by holding a green card holder or spending a significant amount of time in the U.S. (under the Substantial Presence Test)

Basically, if you end up moving to the United States, you’re going to become a U.S. taxpayer. If you’re the employee of the startup, your company may arrange for your relocation to the U.S. as a condition of your employment.

If this happens during your vesting schedule (2023-2027 in the scenario above), then whether you filed an 83(b) election back in the day is going to matter bigtime.

Assuming I didn’t file my 83(b) election and become a U.S. taxpayer, what’s going to happen?

Starting with the year when you become a U.S. taxpayer, you’ll start paying taxes on the FMV of your stock as they vest, just like you would if you had been a U.S. taxpayer from Day 1.

Building off the scenario above, say you move to the U.S. on January 1, 2027. 1/4th of your stock, or 1,000,000 shares, will vest in 2027 at an FMV of at least $1.00 per share. That’s $1,000,000 of income for you in 2027, taxable at the ordinary income tax rate.

And if I had filed my 83(b) election back in the day?

Then you’d be in the clear. Here’s your ideal scenario: you get your 4,000,000 shares in the company and you pay $40 for them (their FMV of $40). This basically means that you got $0 income, since you paid for the stock what they were worth.

You file your 83(b) election within 30 days of getting the stock (by January 30, 2024, in our scenario).

Since you got $0 income by acquiring your shares, your 2024 ordinary income tax liability will be $0. Same for 2025 and 2026. And so, too, for 2027, the year you move to the U.S.

Seems like I should file an 83(b) election. But can I file it?

Yes! The 83(b) election is available when someone gets equity in return for providing services to one’s employer and that equity is subject to vesting. (In case you’re wondering, even as a founder, the company you set up is your employer.)

This applies to U.S. taxpayers and non-U.S. taxpayers alike. The rules for filing are the same, with some considerations to take into account in case you’re a non-U.S. taxpayer and/or reside abroad.

The form is asking for a “Taxpayer Identification Number”. What should I do?

One of the requirements for the 83(b) election is providing the “taxpayer identification number” for the person filing the form. Although it’s not explicitly mentioned in the IRS regulations, if the taxpayer’s spouse is joining in the election, the spouse’s “taxpayer identification number” should also be provided,.

This taxpayer identification number, or Taxpayer ID, can be one of two things:

- Social Security Number, or SSN

- Individual Taxpayer Identification Number, or ITIN

I got an SSN several years ago! Should I use it?

Yes! In some cases, you may have temporarily lived or worked in the U.S. and obtained an SSN during that period. This may have been several years ago, such as during studies in the U.S. If that’s the case and you already have an SSN, go ahead and include it in the form. It’ll help the IRS associate your 83(b) election with your file.

I don’t have an SSN, but I have an ITIN. Should I use it?

Yes! For the same reasons above, including a taxpayer identification number such as an ITIN will help the IRS associate your 83(b) election with your file. That way if you end up moving to the U.S. and becoming a U.S. taxpayer, the IRS will already have your 83(b) election on file.

I don’t have an SSN or an ITIN. What should I do?

If you’re eligible to apply for an SSN, you may want to apply for an SSN.

If you’re not eligible to apply for an SSN, but you’re eligible to apply for an ITIN, you may want to apply for an ITIN. Normally, if you have a U.S. filing or reporting requirement and you’re not eligible to get an SSN, you can apply for an ITIN.

In case you decide to apply for an SSN or ITIN, insert “Applied for” in the respective field on your 83(b) election and submit it like that within the 30-day window. Once you obtain your SSN or ITIN, you can send a follow-up correspondence to the IRS with an updated 83(b) election including your taxpayer identification number.

Find out if you’re eligible to apply for an ITIN here:

https://www.irs.gov/help/ita/am-i-eligible-to-apply-for-an-individual-taxpayer-identification-number

I guess I’m eligible to apply for an SSN or an ITIN, but I don’t want to. What should I do?

You may be reluctant to go through the process of applying for an SSN or ITIN if you’re unsure about your U.S. relocation plans or possibility of becoming a U.S. taxpayer, but you might still want to file that 83(b) election.

In that case, you can submit your 83(b) election with “Foreign individual”, “N/A”, or “Nonresident” filled in in the respective field.

I don’t have an SSN or an ITIN, and I’m not eligible to apply for one. What should I do?

Same here – you can submit your 83(b) election with “Foreign individual”, “N/A”, or “Nonresident” filled in in the respective field.

Credit: Microsoft Designer

Alright, I see I can file an 83(b) election. But how do I file it?

The 83(b) election has to be filed on paper; there’s no option for electronic filing. This can be a real hassle if you’re located outside the United States. That said, don’t fret – there are a few options which we’ll cover in turn below, starting with the best practice tips for filing it.

What’s the best practice on filing procedure?

By now, you’ve already noticed that the 83(b) election is a big deal that you don’t want to mess up. Missing the 30-day deadline is just one way of messing up. Other pitfalls include not being able to prove that you’ve properly filed it or thinking you’ve properly filed it whereas, in fact, you haven’t.

Timely mailing as timely filing

U.S. federal regulations have a rule that says that if you mail your filing on time (within the respective period or by the respective deadline), then it’s assumed that you’ve timely filed it, even if the governmental body you’re mailing it to actually gets your filing after the period or deadline.

In other words, referring to our scenario – if you properly mail out your 83(b) election on January 29, 2024 (before the January 30, 2024 deadline), but the IRS gets your mail on January 31, 2024, then you’re in the clear.

If you’re a legal nerd, here’s the citation for you: 26 U.S. Code § 7502

However, not all kinds of mail are created equal. In short, you either have to send your mail via the U.S. Postal Service or use an IRS-designated private delivery service. More on that later. (You can also use your country’s local postal service too, but the rules that apply in that case will give you a headache and the chance of failure is higher).

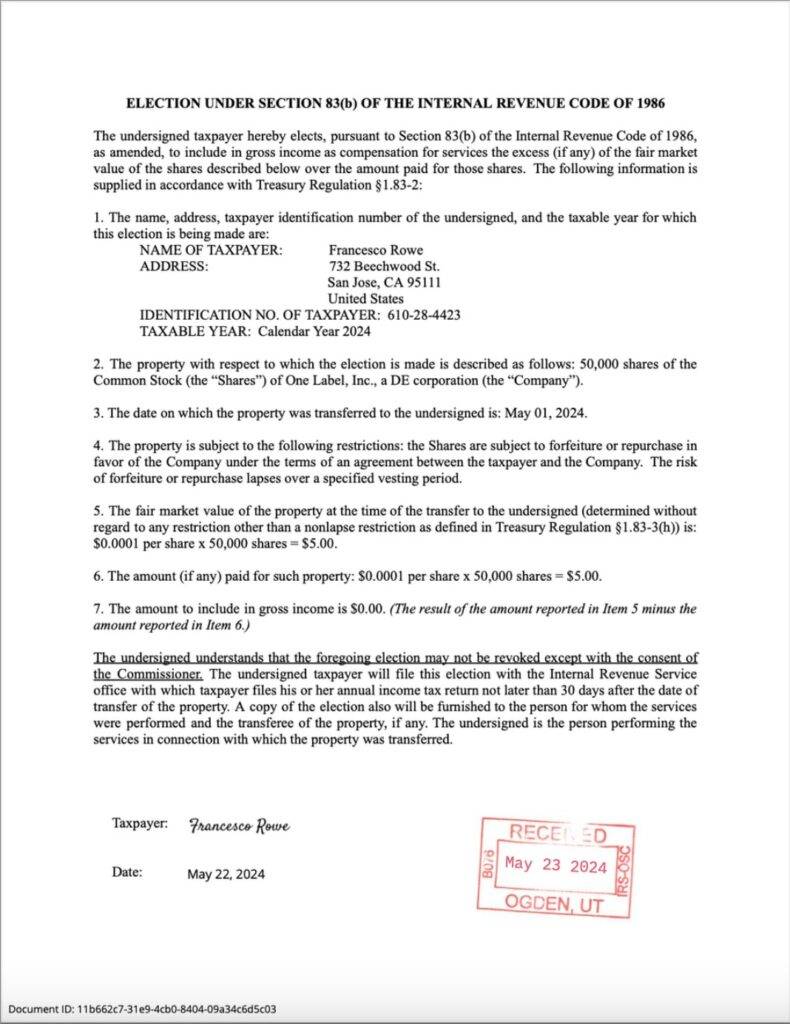

Asking for a date-stamped copy of your filing

Sending your 83(b) election on time is one thing. Proving that you’ve properly sent it on time is another thing. And proving that the IRS in fact received your mail – and the contents of that mail – is a whole other matter.

That’s why it’s suggested to request a date-stamped copy of your filing back from the IRS. What that means is including an additional copy of your 83(b) election or cover letter in your mail along with a postage-paid return envelope. This signals to the IRS that you’re expecting something back from them.

When they get such contents, the IRS employee will take the additional provided copy, stamp it as received on a certain date, and place it in the return envelope and send it back to you.

Here’s what it looks like.

Using an IRS-designated private delivery service

Ok, with best practice covered, let’s see what options you have available for mailing in your 83(b) election from abroad. The first one is using an IRS-designated private delivery service (PDS). Here’s the list of IRS-designated PDS’s:

DHL Express:

- DHL Express 9:00

- DHL Express 10:30

- DHL Express 12:00

- DHL Express Worldwide

- DHL Express Envelope

- DHL Import Express 10:30

- DHL Import Express 12:00

- DHL Import Express Worldwide

FedEx:

- FedEx First Overnight

- FedEx Priority Overnight

- FedEx Standard Overnight

- FedEx 2 Day

- FedEx International Next Flight Out

- FedEx International Priority

- FedEx International First

- FedEx International Economy

UPS:

- UPS Next Day Air Early A.M.

- UPS Next Day Air

- UPS Next Day Air Saver

- UPS 2nd Day Air

- UPS 2nd Day Air A.M.

- UPS Worldwide Express Plus

- UPS Worldwide Express

How can I comply with the “timely mailing” rule when using an IRS-designated PDS?

Most importantly, if you’re going to use a private delivery service, make sure you specifically use one of the services provided above! For example, FedEx Ground is one of the delivery services offered by FedEx, but it’s NOT included in the list below.

So long as you have used one of the explicitly-listed IRS-designated private delivery services above, and you have handed your documents to the PDS before the deadline, you should be fine.

Make sure you hang on to the electronic tracking record provided by the PDS.

How do I request a date-stamped copy of my filing when using an IRS-designated PDS?

This gets a bit tricky. The IRS won’t use a private delivery service to send you back your 83(b) election. So, for example, you won’t be able to include a “paid FedEx Envelope” for the IRS to use to send back your date-stamped filing.

Instead, they will only use USPS, which means your two options are:

- Include an envelope with your foreign address as the return address, with sufficient USPS postage to make the treacherous international mail journey back to you, or

- Include an envelope with a U.S. address as the return address – one that you have access to – and then have your document forwarded to your foreign address or else collect it when you have access to that U.S. address next.

Asking a U.S.-based friend to mail in your 83(b) election

If you have a close friend living in the U.S. and you don’t mind calling on them for a favor, this can be another option. Since 2020, digital signatures are allowed on the 83(b) election, which means you can share a digital copy of your filing with your friend and ask them to deposit it with the U.S. Postal Service (USPS) for you.

How can I comply with the “timely mailing” rule when using USPS?

Just like with private delivery services, not all services provided by the USPS are created equal.

With the U.S. Postal Service, USPS Certified Mail or USPS Registered Mail are the way to go. They’re explicitly referenced in the section covering “timely mailing” and will give you additional protection, such as serving as “legal proof of mailing” and “prima facie proof of delivery” (topics for another post).

Sure, you can also use first class mail (which is the basic tier offered) and, so long as it’s properly postmarked, you would have satisfied the “timely mailing” rule, but you won’t have the additional protections that are afforded by USPS Certified Mail and USPS Registered Mail.

How do I request a date-stamped copy of my filing when using USPS?

Ask your friend to include a postage-paid return envelope along with two copies of your 83(b) election, to be returned to their U.S. address. That way, your date-stamped copy should go back to them, and they can send you the scanned copy, forward you the original, and/or hang on to it until you meet next.

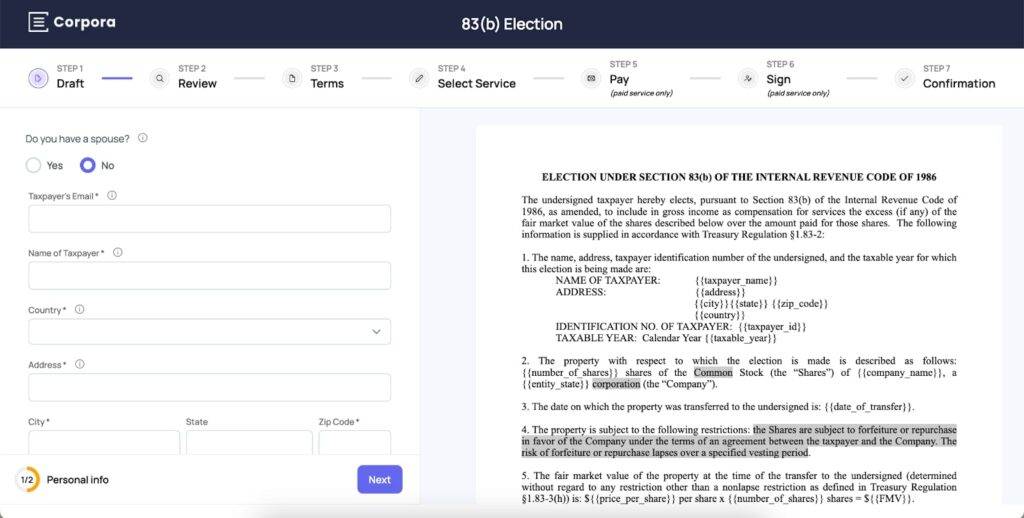

Use Corpora’s 83(b) election platform

Not to toot our own horn, but this will probably be the easiest (and likely the cheapest) option for you. You can draft, review, and sign your 83(b) election online, right through our website. We’ll handle the backend and provide you with updates, including your tracking number, proof of delivery, and date-stamped copy of your filing.

Needless to say, we’ll be doing this by the book, so you don’t have to worry about getting the type of IRS-designated PDS or USPS service right.

Click, click, and check that item off your to-do list.

Where do I send my 83(b) election?

Assuming you’re not a U.S. resident, the address to send your election too will depend on whether you use an IRS-designated PDS or USPS.

Filing address when using an IRS-designated PDS

If you’re using one of the IRS-designated DHL, FedEx, or UPS services, send your documents to:

Austin – Internal Revenue Submission Processing Center

3651 S IH35,

Austin TX 78741

USA

Filing address when using USPS

If you’re using USPS instead, send your documents to:

Department of the Treasury

Internal Revenue Service

Austin, TX 73301-0215

USA

What if I am a U.S. resident?

The result again depends on whether you’re using an IRS-designated PDS or USPS.

- In case you’re going to use USPS, consult this list.

- And in case you’re going to use an IRS-designated PDS, consult this list (after you’ve consulted the list above, since it’s relevant).

Conclusion

Even if you’re not a U.S. taxpayer, chances are filing an 83(b) election while you have the chance is the smart move. You have significant upside in case you do and basically nothing to lose (other than the time and expense put into filing the document). We’ve tried to make this as easy as possible for you at Corpora through our online platform. But even if you don’t want to use our platform, we’re still always happy to help to make sure you get this critical filing right.

DISCLAIMER: This post is not intended as legal, tax, or any kind of professional advice. This post also sacrifices detail for simplicity. Make sure you consult with an attorney, tax, or other professional on your situation.