This is the thirteenth post of Mistakes Founders Make, a series of blog posts that shine light on legal mistakes that startups commonly make and attorneys have to fix. Keep in mind that the post sacrifices detail for simplicity and is for informational purposes only. It should not be taken as advice — whether legal, tax, or other — and does not create an attorney-client relationship.

Just the basics

What’s the problem?

To be fully functional, a Delaware corporation must have one or more directors, officers, stockholders, and Bylaws. However, founders often fall short on one or more of these points.

How bad is it?

It depends on how late you recognize the mistake, and what actions have been taken in the meantime. For example, if you hadn’t formally appointed your Board and the “self-professed” Board granted stock options, you may have a lot of painful work to do.

How do I avoid this?

Be methodical, just like corporate law is. If you’d like, use this blog post as an outline to go back and check your initial corporate documents to see if everything was covered. If in doubt, reach out to a competent corporate attorney.

What are “post-incorporation essentials”?

Right after your Delaware corporation is “filed” (or officially set up), there are a few actions you should take:

- Appoint your Board of Directors: The main strategic decision-making body of a corporation is its Board, and every Delaware corporation must have at least one director.

- Adopt your Bylaws: The Bylaws lay out the main rules based on which a corporation and its affairs are to be governed. It covers matters such as how meetings are held, how decisions are made, how directors and officers are appointed, and rules pertaining to its stock.

- Appoint your officers: The day-to-day operations of a corporation are handled by its officers, such as the CEO, Secretary, and CFO. Delaware law requires corporations to have a Secretary, although, commonly, corporations also have a CEO and CFO.

- Issue stock: A corporation should have owners, also known as stockholders. Unless the corporation formally issues stock to one or more persons, it will be owner-less.

While there are other post-incorporation actions that may need to be taken, these are the more critical ones which founders sometimes oversee.

Ok, let’s take this step by step. How do you appoint the Board of Directors?

There are two common ways of taking care of this in a new corporation.

- The directors can be named in the original Certificate of Incorporation.

- The incorporator can adopt an “Incorporator’s Consent,” appointing the directors.

Until one of these happens, the incorporator continues to have the authority to act on behalf of the corporation. So, if neither of these steps have been taken previously, the corporation doesn’t have an official Board, and any decisions adopted by “self-professed” directors can potentially be voided.

To be clear, the incorporator is the person that prepares, signs, and files the Certificate of Incorporation with the Delaware Secretary of State. This is usually the attorney handling the incorporation or one of the founders.

Understood. How do you adopt the Bylaws?

This is normally taken care of by the Board in its first decision, which is commonly called the “Unanimous Written Consent of the Board of Directors in Lieu of Organizational Meeting” (indeed, a long, funky name). This consent usually has the Bylaws attached as an exhibit and includes language saying that those Bylaws are adopted and approved. Until this happens, the corporation does not have Bylaws.

When you say “company loses its right to take back equity,” what exactly do you mean?

In the case of options, this means that the optionholder (the person who received the options) can exercise the “vested” options. They won’t be forfeited when this person leaves the company until they’ve had the chance to exercise the options.

In the case of restricted stock, this means that the stock recipient gets to keep the vested stock and the company cannot repurchase them.

I see. And how do you appoint the officers?

This, too, is normally carried out through this written consent with a peculiar name. The Board adopts a resolution appointing certain individuals as officers. The same individual can be appointed to one or more positions. Until this happens, the corporation does not have officers, and, so, the actions taken by “self-professed” officers can potentially be voided.

Got it. And how about issuing stock?

This is a big one that is often overlooked by founders. The Board must adopt a resolution agreeing to grant (or “issue”) stock to one or more persons. This, too, is normally taken care of through the mentioned written consent (though some incorporation services prepare a separate consent for this).

If the Board hasn’t adopted such a resolution and the corporation and its founders have acted as though they own stock, then you’re potentially looking at a situation where you have to adopt a Board resolution “ratifying” the issuance. This is one of those matters where you would want to work with an attorney, since this resolution will likely have special language on “putative stock,” “defective corporate act,” “void or voidable,” and other niche legal lingo that only lawyers understand.

What do I do to avoid running into problems here?

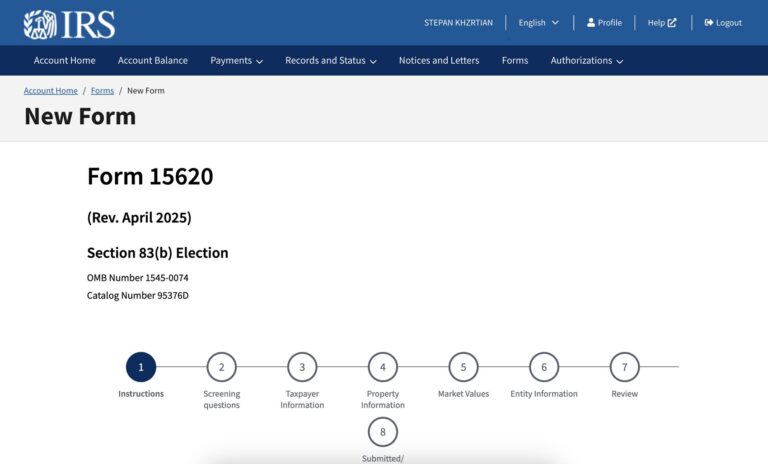

Corporate law is very methodical. Think of this post as a checklist and go through your first corporate documents to see if all of these points were covered. Most incorporation services take care of post-incorporation matters as well, but it’s ultimately on the founders to make sure that all of these steps have been properly implemented. For example, one problem I’ve seen several times is the founders not paying the purchase price for their stock or not filing their 83(b) elections.